International Business Machines (IBM)

298.93

+9.04 (3.12%)

NYSE · Last Trade: Feb 7th, 6:05 PM EST

Detailed Quote

| Previous Close | 289.89 |

|---|---|

| Open | 292.50 |

| Bid | 298.85 |

| Ask | 298.93 |

| Day's Range | 290.66 - 299.89 |

| 52 Week Range | 214.50 - 324.90 |

| Volume | 3,744,318 |

| Market Cap | 271.44B |

| PE Ratio (TTM) | 56.72 |

| EPS (TTM) | 5.3 |

| Dividend & Yield | 6.720 (2.25%) |

| 1 Month Average Volume | 5,204,940 |

Chart

About International Business Machines (IBM)

International Business Machines is a multinational technology company that specializes in providing a wide range of services and products in the fields of information technology, cloud computing, and artificial intelligence. The company is renowned for its commitment to innovation, offering advanced hardware and software solutions, including mainframe computers, data analytics, and enterprise software. IBM also focuses on consulting services, helping organizations adopt digital transformation strategies and optimize their operations, while maintaining a strong emphasis on research and development to drive future technological advancements. Read More

News & Press Releases

UiPath has flown under the media's radar despite some heavy Wall Street investment late last year, is it worth a look?

Via The Motley Fool · February 7, 2026

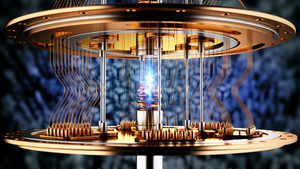

Quantum computing is an exciting opportunity, but the technology is young, and the pure plays are still highly risky investments. Fortunately, you don't need to swing for the fences with your stock picks to win.

Via The Motley Fool · February 6, 2026

In a move that has sent shockwaves through Silicon Valley and Wall Street alike, Alphabet Inc. (NASDAQ: GOOGL) has unveiled a staggering capital expenditure outlook for 2026, signaling its intent to lead the next era of computing at any cost. Following its Q4 2025 earnings report, the tech giant announced

Via MarketMinute · February 6, 2026

Executives Optimistic AI Will Generate Revenue but Unsure How

Corporate leaders are confident their investments in AI will deliver financial rewards by the end of the decade. What remains far less certain is how those returns will actually be generated.

Via Investor Brand Network · February 5, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026

In a landmark announcement that has sent shockwaves through both Silicon Valley and the global energy sector, Meta Platforms, Inc. (NASDAQ: META) has unveiled "Meta Compute," a massive strategic pivot that positions physical infrastructure as the company’s primary engine for growth. CEO Mark Zuckerberg detailed a roadmap that moves beyond social media and into the [...]

Via TokenRing AI · February 6, 2026

In a landmark week for the global semiconductor industry, Japan’s state-backed chip venture, Rapidus, has announced a series of critical milestones that bring the nation closer to reclaiming its status as a premier manufacturing powerhouse. As of February 2026, Rapidus has officially transitioned from an ambitious blueprint to a functional operational entity, releasing its first [...]

Via TokenRing AI · February 6, 2026

The long-awaited "deal drought" has officially broken. As of early February 2026, the American financial landscape is being reshaped by a massive resurgence in corporate deal-making, punctuated by a staggering 111.5% year-over-year increase in transactions valued over $100 million at the close of 2025. This tidal wave of capital

Via MarketMinute · February 6, 2026

As of February 6, 2026, the technology sector is witnessing a historic resurgence in a corner of the market once considered "legacy": data storage. Western Digital Corp. (NASDAQ: WDC) has emerged as the standout performer of the first quarter, with its stock price surging over 28% in the first week of February alone. This rally [...]

Via Finterra · February 6, 2026

The company's stock has soared over 250% in the past year.

Via The Motley Fool · February 5, 2026

One year after officially closing its $6.4 billion acquisition of HashiCorp, International Business Machines Corp. (NYSE:IBM) has successfully transformed its software portfolio, positioning itself as the central nervous system for modern multi-cloud environments. By merging HashiCorp’s ubiquitous infrastructure-as-code and security tools with the industrial-grade power of Red

Via MarketMinute · February 5, 2026

Digital Realty's data center business is booming as the AI market expands.

Via The Motley Fool · February 5, 2026

In a series of candid warnings delivered at the 2026 World Economic Forum in Davos and during recent high-profile interviews, IBM (NYSE: IBM) Chairman and CEO Arvind Krishna has sounded the alarm on what he calls the "$8 trillion math problem." Krishna argues that the current global trajectory of capital expenditure on artificial intelligence infrastructure [...]

Via TokenRing AI · February 5, 2026

In a historic turning point for the global electronics industry, Japan has officially reclaimed its status as a top-tier semiconductor superpower. As of February 5, 2026, a series of strategic maneuvers by the Japanese government, anchored by massive subsidies and international partnerships, has successfully lured the world's most advanced manufacturing processes back to the archipelago. [...]

Via TokenRing AI · February 5, 2026

The era of brute-force artificial intelligence is facing a reckoning. As the power demands of traditional data centers soar to unsustainable levels, Intel Corporation (NASDAQ: INTC) has unveiled a radical alternative that mimics the most efficient computer known to exist: the human brain. Hala Point, the world’s largest neuromorphic system, marks a definitive shift from [...]

Via TokenRing AI · February 5, 2026

IBM wins a role in the Missile Defense Agency's SHIELD framework and reinforces its broader AI strategy with a new education-focused initiative.

Via Benzinga · February 5, 2026

Via Benzinga · February 5, 2026

Technical analysis on the stock chart for IBM.

Via Talk Markets · February 4, 2026

IBM stock slipped as Anthropic announces new plugins that threaten its consulting and software business. But Jim Cramer continues to favor owning IBM shares in 2026.

Via Barchart.com · February 4, 2026

IonQ is the most popular quantum computing stock. It's not necessarily the best investment in 2026.

Via The Motley Fool · February 4, 2026

IBM’s Q4 performance was marked by growth in software and infrastructure, which drove the company to surpass Wall Street’s revenue and profit expectations. Management credited the momentum to strong demand for AI- and automation-centric solutions, as well as continued adoption of its Z17 mainframe platform. CEO Arvind Krishna noted that “software grew 9%, our highest annual growth rate in history,” highlighting the impact of IBM’s focus on hybrid cloud and AI. Consulting services also contributed modestly, with clients increasingly seeking help to integrate AI at scale.

Via StockStory · February 4, 2026

A number of stocks fell in the morning session after disappointing fourth-quarter results from industry bellwether Gartner sparked widespread concerns about a slowdown in the sector.

Via StockStory · February 3, 2026

The past year hasn't been kind to the stocks featured in this article.

Each has tumbled to their lowest points in 12 months, leaving investors to decide whether they're witnessing fire sales or falling knives.

Via StockStory · February 2, 2026

IT services provider ASGN (NYSE:ASGN) will be announcing earnings results this Wednesday after market hours. Here’s what to look for.

Via StockStory · February 2, 2026

There are lots of quantum computing start-ups, but IBM, America's first tech company, has led the pack since the 1970s, and is set to continue that dominance through 2026 and beyond.

Via The Motley Fool · February 2, 2026