News

On March 10, 2026, Oracle outperformed in after-hours trading and oil prices fell in a volatile, energy-driven session.

Via The Motley Fool · March 10, 2026

Stay ahead in 2026 with insights on geopolitical events and their effects on investing strategies. Adapt and thrive in this climate.

Via The Motley Fool · March 10, 2026

The VIX has spiked. Can anything bring the markets back under control?

Via The Motley Fool · March 10, 2026

NEW YORK — In a dramatic shift of market leadership, the Russell 2000 index (INDEXRUSSELL:RUT) continued its historic outperformance on Tuesday, March 10, 2026, as investors aggressively rotated capital out of mega-cap technology "titans" and into small-cap value plays. While the tech-heavy Nasdaq Composite (INDEXNASDAQ:.IXIC) struggled to remain in

Via MarketMinute · March 10, 2026

Via Talk Markets · March 10, 2026

In a striking divergence on Wall Street, the financial sector emerged as a notable laggard during Tuesday’s trading session. On March 10, 2026, the Financial Select Sector SPDR Fund (NYSEARCA:XLF) slipped 0.5%, even as the broader S&P 500 climbed 0.42% and the tech-heavy Nasdaq Composite

Via MarketMinute · March 10, 2026

The CBOE Volatility Index (VIX), often referred to as Wall Street’s "fear gauge," experienced a dramatic 13.5% decline on March 10, 2026, signaling a sharp relief rally across global equity markets. This significant contraction in expected volatility follows nearly two weeks of extreme market duress triggered by the

Via MarketMinute · March 10, 2026

The U.S. Treasury market reached a precarious equilibrium on March 10, 2026, as the benchmark 10-year yield stabilized around the 4.15% mark. This leveling off comes after a tumultuous start to the year, driven by a complex tug-of-war between deteriorating employment figures and a renewed inflationary impulse stemming

Via MarketMinute · March 10, 2026

As of March 10, 2026, the financial markets are grappling with a paradox of success at Costco Wholesale (NASDAQ: COST). Just days after the warehouse giant reported a robust fiscal second-quarter earnings beat, the conversation on Wall Street has shifted from the strength of its membership model to the sustainability

Via MarketMinute · March 10, 2026

As the middle of March 2026 approaches, investors are bracing for a week of "March Madness" that has nothing to do with basketball and everything to do with the future of the global economy. With the Consumer Price Index (CPI) report for February 2026 scheduled for release tomorrow, March 11,

Via MarketMinute · March 10, 2026

In a decisive move to stabilize global energy markets, the G7 nations on March 10, 2026, officially launched "Operation Maritime Shield," a coordinated naval escort initiative designed to secure the safe passage of commercial vessels through the Strait of Hormuz. The announcement, led by a joint statement from the U.

Via MarketMinute · March 10, 2026

On a day marked by deepening global uncertainty and a sharp spike in energy costs, the healthcare sector emerged as the primary beneficiary of a massive "risk-off" migration by institutional investors. As of the market close on March 10, 2026, the Healthcare Select Sector SPDR Fund (NYSEARCA:XLV) gained 1%

Via MarketMinute · March 10, 2026

The U.S. labor market sent a seismic shock through global financial markets on Tuesday, March 10, 2026, as the Bureau of Labor Statistics reported a staggering contraction in non-farm payrolls for February. While economists had braced for a modest gain of roughly 70,000 jobs, the actual figure plummeted

Via MarketMinute · March 10, 2026

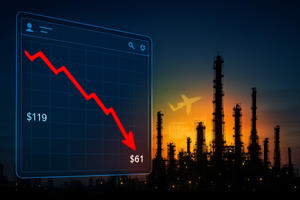

NEW YORK — In a dramatic reversal that has caught energy traders off guard, West Texas Intermediate (WTI) crude oil prices plummeted on Tuesday, March 10, 2026, falling into the $81 to $90 range after hitting a terrifying weekend high of nearly $119 per barrel. This sharp 25% retreat from the

Via MarketMinute · March 10, 2026

Income Disruption Risk and Long Term Financial Stability in Volatile Economic Cycles

Financial markets fluctuate in response to interest rate shifts, inflation data, employment reports, and geopolitical tension. Investors track these indicators closely because they influence portfolio performance and long term capital growth. However, market volatility does not only affect institutional traders or hedge funds. It also shapes household income stability, particularly for individuals whose earnings depend on consistent employment and physical capacity to work.

Via AB Newswire · March 10, 2026

In a dramatic reversal of fortune, the U.S. stock market staged a powerful relief rally on Tuesday, March 10, 2026, as investors seized on optimistic rhetoric regarding the conflict in the Middle East. After opening the session in deep red territory following a week of escalating hostilities, major indices

Via MarketMinute · March 10, 2026

The S&P 500 Index ($SPX ) (SPY ) on Tuesday fell -0.21%, the Dow Jones Industrial Average ($DOWI ) (DIA ) fell -0.07%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) fell -0.04%. March E-mini S&P futures (ESH26 ) fell -0.11%, and March E-mini Nasd...

Via Barchart.com · March 10, 2026

What Happened? Shares of biotech company Vertex Pharmaceuticals (NASDAQ:VRTX) jumped 8.3% in the afternoon session after the company announced positive resul...

Via StockStory · March 10, 2026

What Happened? Shares of solar tracker company Nextpower (NASDAQ:NXT) jumped 5.1% in the afternoon session after GLJ Research initiated coverage on the compa...

Via StockStory · March 10, 2026

A number of stocks fell in the afternoon session after investors grappled with heightened geopolitical tensions and broader economic uncertainty.

Via StockStory · March 10, 2026

What Happened? Shares of laser company nLIGHT (NASDAQ:LASR) jumped 5.5% in the afternoon session after the market reacted to the company's successful pivot i...

Via StockStory · March 10, 2026

What Happened? Shares of network testing solutions company Viavi Solutions (NASDAQ:VIAV) jumped 3.4% in the afternoon session after the company announced the...

Via StockStory · March 10, 2026

What Happened? Shares of solar power systems company SolarEdge (NASDAQ:SEDG) jumped 9.3% in the afternoon session after Bank of America upgraded the stock to...

Via StockStory · March 10, 2026

Oil is doing something I haven't seen it do in a long time. Here's what it means and how to profit.

Via Barchart.com · March 10, 2026

The dollar index (DXY00 ) on Tuesday spent most of the day on the downside, then recovered a bit in the afternoon, ending little changed. The dollar came under downward pressure from Tuesday's nearly -12% plunge in oil prices, which was dovish for F...

Via Barchart.com · March 10, 2026