Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Indian share markets are trading lower, with the Sensex trading 268 points lower, and the Nifty is trading 101 points lower.

Via Talk Markets · February 6, 2026

The Pound has seen gains against the dollar erased as the pair continues to sell off.

Via Talk Markets · February 6, 2026

German industrial production disappointed at the end of the year, but this is only a temporary halt, not a new downward trend. An industrial upswing is clearly in the making

Via Talk Markets · February 6, 2026

AUD/CAD remains in the positive territory after recovering its daily losses, trading around 0.9520 during the European hours on Friday.

Via Talk Markets · February 6, 2026

In this video, Ira Epstein covers the recent turmoil in the metals and stock markets, highlighting significant declines such as silver reaching $64 an ounce and gold dropping $1,000 from its peak.

Via Talk Markets · February 6, 2026

The Indian Rupee (INR) trades lower against the US Dollar (USD) during afternoon trading hours in India on Friday.

Via Talk Markets · February 6, 2026

Bearish momentum dominates as the market tests major support at November’s lows and December’s lows. This video highlights a

Via Talk Markets · February 5, 2026

The oil markets had a negative day today.

Via Talk Markets · February 5, 2026

The USD/CAD pair trades with mild losses near 1.3685 during the early European session on Friday. The US Dollar softens against the Canadian Dollar amid weaker-than-expected US economic data and a rise in crude oil prices.

Via Talk Markets · February 6, 2026

Market indexes scuba-dived today: went below the surface and stayed there, across the board. Bitcoin, metals and apparently equities are all being painted with the same quivering-hand brush.

Via Talk Markets · February 5, 2026

Alphabet reported fourth-quarter and full year results that exceeded expectations, with revenue climbing 18% and annual sales surpassing $400 billion for the first time.

Via Talk Markets · February 5, 2026

HOOD transformed from an upstart stock-trading app that became famous in the early months of Covid into an S&P 500 giant and a direct competitor to Fidelity and other online brokerages.

Via Talk Markets · February 5, 2026

This analysis compares China’s official GDP against alternative activity indicators, highlighting a growing divergence. While official figures remain steady, satellite data and trade proxies suggest a more significant economic cooling.

Via Talk Markets · February 5, 2026

After opening lower, the Indian market dragged further as the session progressed and ended the day lower.

Via Talk Markets · February 5, 2026

SPX futures consolidated above the trendline overnight, testing Intermediate resistance at 6810.00.

Via Talk Markets · February 5, 2026

The fall from last week’s spike higher seems to have slowed to nothing, as the price consolidates above $1.1775.

Via Talk Markets · February 5, 2026

Strategy (previously known as Microstrategy) reported a net loss of $12.4 billion for the fourth quarter of 2025 after Bitcoin fell from about $120,000 to roughly $89,000 over the period, according to CoinDesk.

Via Talk Markets · February 5, 2026

A new Senate bill aims to prevent data centers from passing their massive energy infrastructure costs onto utility customers. The legislation requires AI and tech firms to fund their own grid upgrades, protecting households from rising rates.

Via Talk Markets · February 5, 2026

With Amazon down a double-digit percentage, it’ll be interesting to see who wins the day tomorrow: will the over-stretched NQ spring back higher temporarily, or will AMZN be bad enough to make the stretched even more over-stretched?

Via Talk Markets · February 5, 2026

In this video, Ira Epstein discusses key developments in the financial markets, highlighting the upcoming US-Iran talks and their potential impact on futures markets.

Via Talk Markets · February 5, 2026

Each week we run a DCF (Discounted Cash Flow) model on a company from our watchlist. This week’s pick: The Walt Disney Company (DIS).

Via Talk Markets · February 5, 2026

The U.S. top marginal income tax rate has averaged 56% since 1913.

Via Talk Markets · February 5, 2026

This article will analyze Firm Capital Mortgage Investment in greater detail.

Via Talk Markets · February 5, 2026

While gold reclaims $5,000, Bitcoin has cratered below $65,000, acting as a

Via Talk Markets · February 5, 2026

Nacco Industries is trading at a new 3-year high. NC stock is up more than 70% over the past year and has robust technical momentum.

Via Talk Markets · February 5, 2026

Gold price tumbles to around $4,680 during the early Asian session on Friday. The precious metal extends the decline as traders cover losses from equities and adjust positions.

Via Talk Markets · February 5, 2026

It is hard to believe that the S&P 500 is only 2–3% below its all-time high, given the carnage across various parts of the market.

Via Talk Markets · February 5, 2026

The Euro extends its losses on Thursday as the European Central Bank held rates unchanged in an uneventful monetary policy decision.

Via Talk Markets · February 5, 2026

Equities are getting sold, oil and gas are getting clobbered, the metals are being sold hard, and Bitcoin is getting clobbered, too. But bonds are barely reacting.

Via Talk Markets · February 5, 2026

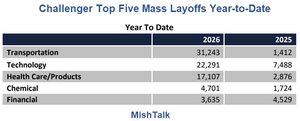

It’s more grim data to start the year.

Via Talk Markets · February 5, 2026

Weak US economic data and risk-off led to a drop in Treasury yields.

Via Talk Markets · February 5, 2026

Every sector closed red today except utilities. That lone green sector tells you exactly where capital is flowing. Money is leaving stocks and moving into bonds, cash, and dividend payers.

Via Talk Markets · February 5, 2026

Tryg A/S provides insurance services. It operates through the following segments: Private, Commercial, Corporate and Other.

Via Talk Markets · February 5, 2026

Long-term Treasury bonds have lost their appeal as yields rise and confidence falters, while gold’s bull market continues. It claims this reflects weaker faith in U.S. credit and growing demand for gold as a safe haven.

Via Talk Markets · February 5, 2026

The 24% YoY increase in AWS revenue not only smashed estimates, but was the highest in three years: remarkable growth for a business that keeps growing and has a more difficult base effect to

Via Talk Markets · February 5, 2026

The rich have been spending so amply that they've kept the averages for retail spending -- which drives the majority of our GDP -- in

Via Talk Markets · February 5, 2026

The Dow lost nearly 600 points on Thursday, while the Nasdaq suffered a triple-digit drop as well, marking its third-straight loss alongside the S&P 500 as investors continued to rotate out of tech.

Via Talk Markets · February 5, 2026

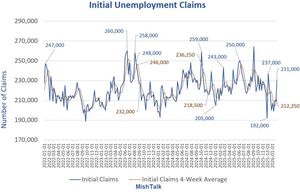

Initial claims unexpectedly spiked to 231,000.

Via Talk Markets · February 5, 2026

Crude OIl markets are easing into the low side on Thursday.

Via Talk Markets · February 5, 2026

The 25Q4 Y/Y blended earnings growth estimate is 69.9%. If the energy sector is excluded, the growth rate for the index is 79.8%.

Via Talk Markets · February 5, 2026

While software is in the red since Trump's tariff turmoil, the two groups where stocks are up the most are in the hardware space.

Via Talk Markets · February 5, 2026

Rice was higher again yesterday and trends are up. Traders anticipate less production this year in the U.S. and around the world due to low prices.

Via Talk Markets · February 5, 2026

People using tools like Claude Code have been genuinely surprised by how different the experience feels.

Via Talk Markets · February 5, 2026

Gold slides to $4,880 as broad US Dollar strength and profit-taking weigh on precious metals.

Via Talk Markets · February 5, 2026

The next support is just below $60k, but bitcoin could decline briefly all the way to $50k.

Via Talk Markets · February 5, 2026

Spot Silver prices found fresh room on the downside on Thursday.

Via Talk Markets · February 5, 2026

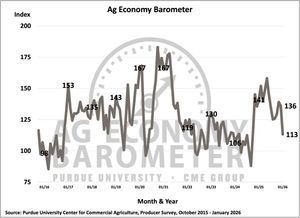

Given this outlook, it’s not surprising that the outlook for capital investment is poor. Only 4% of respondents expected to increase farm machinery spending over the next 12 months.

Via Talk Markets · February 5, 2026

Microsoft recently announced strong quarterly results, but despite their performance, the market was not happy.

Via Talk Markets · February 5, 2026

An apparent slowdown in hiring suggests the Fed may have acted a little prematurely in downplaying the risks to the jobs aspect of its mandate at the January FOMC meeting.

Via Talk Markets · February 5, 2026

The recent wave of selling hitting the market has been thematic. The AI trade has taken its lumps, and crypto stocks have sold off sharply in tow.

Via Talk Markets · February 5, 2026

Panic buy doesn't even make sense. But when you see stuff go on like this, it's really very manic in terms of trade, and that's never a good thing.

Via Talk Markets · February 5, 2026

Snapchat has been one of the worst stocks in the market over the last five years. It just hasn’t seemed to be able to get its act together.

Via Talk Markets · February 5, 2026

Chainlink mirrored the broader cryptocurrency market’s dump on Thursday, February 5, 2026 as LINK reached multi-year lows last seen in October 2023.

Via Talk Markets · February 5, 2026

The Canadian Dollar weakened slightly against the US Dollar on Thursday.

Via Talk Markets · February 5, 2026

The broader cryptocurrency market has continued its poor start to the month, with over $355 million worth of leveraged positions wiped out within the last 60 minutes.

Via Talk Markets · February 5, 2026

Just when Goldman's long-time Novo Nordisk bull James Quigley likely thought the downside was exhausted, the stock plunged yet again on Thursday after tumbling earlier this week following a dismal sales outlook.

Via Talk Markets · February 5, 2026

Wall Street is extending its slide Thursday, as investors lean into a risk-off attitude amid another selloff in tech and crypto stocks.

Via Talk Markets · February 5, 2026

If you have been watching Nvidia lately, you have probably noticed the excitement has cooled off. The stock that led the market higher has gone nowhere for months.

Via Talk Markets · February 5, 2026

The UK's FTSE 100 slipped on Thursday, pressured by a decline in Shell shares after the oil giant reported quarterly profits that fell short of expectations.

Via Talk Markets · February 5, 2026

Natural gas volatility is almost as crazy as the weather as we should see a record-breaking withdrawal in weekly inventory.

Via Talk Markets · February 5, 2026

The outlook for the Dutch retail sector is looking bright over the year ahead, with an expected turnover growth of 4.5%. We see increased purchasing power prompting consumers to spend more, both in the high street and in supermarkets.

Via Talk Markets · February 5, 2026

Barring another glitch in the federal government’s on-again-off-again operating schedule, the delayed report for the fourth-quarter GDP report is set for release in two weeks (Feb. 20).

Via Talk Markets · February 5, 2026

After rising to an all-time high of 4,025 tonnes in 2025, ETF gold holdings continued to climb in January, growing by another 120.1 tonnes.

Via Talk Markets · February 5, 2026

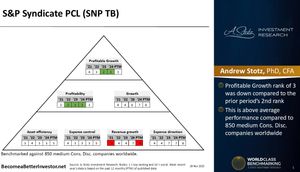

S&P Syndicate Public Company Limited operates a nationwide restaurant and bakery chain in Thailand and internationally.

Via Talk Markets · February 5, 2026

Gold is not about predicting tops or timing entries. It is about quietly improving portfolio efficiency, reducing drawdowns, and owning something that behaves differently when it actually counts.

Via Talk Markets · February 5, 2026

Gold consolidates as weak U.S. labor data boosts expectations of Fed easing. Persistent geopolitical tensions and a well-defined long-term uptrend continue to support the bullish case.

Via Talk Markets · February 5, 2026

Hims & Hers stock rose over 10% after the company unveiled plans to sell a cheaper compounded version of Novo Nordisk’s Wegovy pill.

Via Talk Markets · February 5, 2026

Initial claims rose 22,000 to 231,000, except for one week the highest since early November.

Via Talk Markets · February 5, 2026

Markets this week have once again been sending mixed signals, though perhaps not as severe as the crash in precious metals last week.

Via Talk Markets · February 5, 2026

According to the International Monetary Fund, six of the seven largest developed economies now carry government debt equal to or greater than their annual economic output.

Via Talk Markets · February 5, 2026

Recent earnings reports reveal mixed performances, with KKR and Cummins Inc. facing challenges, while The Cigna Group surpasses expectations.

Via Talk Markets · February 5, 2026

The ECB has kept interest rates on hold but points to uncertainty, demonstrating high alertness amid its ongoing wait-and-see stance.

Via Talk Markets · February 5, 2026

With Silver down 13% on the day and the recent bounce failing to hit key Fibonacci retracement levels, the

Via Talk Markets · February 5, 2026

At the start of November 2025, the U.S. and China reached a new truce in their tariff war, which started almost seven months earlier.

Via Talk Markets · February 5, 2026