Chevron Corp (CVX)

183.74

+1.34 (0.73%)

NYSE · Last Trade: Feb 15th, 7:40 AM EST

The energy sector has soared in 2026, surprising many analysts.

Via The Motley Fool · February 14, 2026

In a move that signals the final stage of a multi-year consolidation wave in the American energy sector, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) announced a definitive $58 billion all-stock merger on February 2, 2026. This blockbuster transaction, framed as a "merger of equals," creates a premier

Via MarketMinute · February 13, 2026

The Treasury Department on Friday issued a general license allowing certain large oil companies to invest in new oil-and-gas operations in the Latin American country.

Via Stocktwits · February 13, 2026

In a move that signals the dawn of a new era for the American energy landscape, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) have officially announced a definitive merger agreement to create a $58 billion "super-independent" powerhouse. The $21.4 billion all-stock transaction, unveiled on February 2, 2026,

Via MarketMinute · February 13, 2026

As of February 12, 2026, the financial markets are witnessing a dramatic reversal of the decade-long "growth over value" narrative. In the first six weeks of the year, the S&P 500 Energy sector has surged to become the market's undisputed leader, posting a gain of over 14% and significantly

Via MarketMinute · February 12, 2026

In a move that signals the dawn of a new era for independent energy producers, Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) announced a definitive $58 billion merger agreement on February 2, 2026. This all-stock "merger of equals" is designed to create a premier large-cap shale operator, specifically

Via MarketMinute · February 12, 2026

Our senior market strategist explains the secular sector rotation taking place in the market right now.

Via Barchart.com · February 12, 2026

Chevron is up big in 2026 as part of a rip-roaring rally in energy stocks.

Via The Motley Fool · February 12, 2026

As of February 11, 2026, the global energy market has become a theater of conflicting forces, leaving investors and analysts grappling with unprecedented volatility. On one side, the U.S. administration’s aggressive "Drill, Baby, Drill" policy has unleashed a torrent of new domestic production, pushing West Texas Intermediate (WTI)

Via MarketMinute · February 11, 2026

As the Trump administration enters its second year, a seismic shift in the American legal and economic landscape is reaching a fever pitch. What began as a series of "Day One" executive orders has evolved into a massive, coordinated legal offensive by U.S. corporations to dismantle the regulatory framework

Via MarketMinute · February 11, 2026

WASHINGTON D.C. — In a sweeping transformation of the federal government not seen in decades, the Office of Budget, Balance, and Bureaucratic Accountability (OBBBA) has initiated a massive "operational efficiency" review, marking the formal beginning of what Wall Street is calling the "Great Regulatory Purge." This aggressive restructuring, authorized under

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy landscape finds itself trapped in a high-stakes waiting game. Despite a cooling U.S. labor market and "weaker than expected" retail sales, oil prices remain stubbornly resilient, underpinned by a thick layer of geopolitical anxiety. The primary driver is the ongoing diplomatic

Via MarketMinute · February 11, 2026

In a move that signals the next massive wave of consolidation in the American energy sector, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) have announced a definitive agreement to combine in an all-stock "merger of equals" valued at approximately $58 billion. Announced on February 2, 2026, the transaction

Via MarketMinute · February 11, 2026

Two of the stocks seem like good buys -- the other has fallen by nearly half.

Via The Motley Fool · February 11, 2026

The S&P 500 has spent the early weeks of 2026 dancing on the edge of history, repeatedly testing the psychological and technical barrier of the 7,000 mark. After a relentless climb throughout 2025, the world’s most-watched equity index briefly eclipsed the milestone on January 28, 2026, hitting

Via MarketMinute · February 11, 2026

In a move that signals the most significant realignment of Western energy interests in South America in decades, the U.S. Department of the Treasury has issued General License 48 (GL 48). This landmark policy shift authorizes U.S. companies to resume the delivery of critical oil production equipment, technology,

Via MarketMinute · February 11, 2026

As of February 11, 2026, the global energy landscape is teetering on the edge of a significant supply disruption following a series of aggressive maritime interdictions by the United States. On February 9, US naval forces successfully boarded and seized the Aquila II, a crude oil tanker allegedly part of

Via MarketMinute · February 11, 2026

As delegates and energy titans gather in London for the 2026 International Energy Week (IE Week), the mood has shifted from the supply-security anxieties of years past to a starker, more bearish reality. A new consensus has emerged among top analysts and institutional forecasters, placing the outlook for Brent Crude

Via MarketMinute · February 11, 2026

Chevron takes on commodity risk, while Enterprise tries to avoid it.

Via The Motley Fool · February 11, 2026

Chevron could have a huge year.

Via The Motley Fool · February 11, 2026

On 30 January, Chevron increased its dividend by 4.09%, from $1.71 to $1.78 per share. The dividend is payable on 10 March to shareholders of record on 17 February.

Via Talk Markets · February 10, 2026

The Vanguard High Dividend Yield ETF and the Schwab U.S. Dividend Equity ETF both aim to deliver reliable income, but they go about it in very different ways. This comparison explains which approach is better suited for investors who depend on their dividends to hold steady through changing markets.

Via The Motley Fool · February 10, 2026

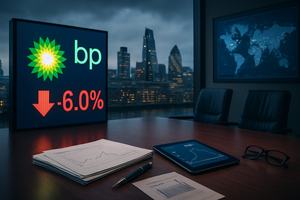

In a move that sent ripples through the global energy sector, BP (NYSE: BP) announced on February 10, 2026, that it would immediately suspend its $750 million quarterly share buyback program. The decision marks a dramatic departure from the company’s recent strategy of aggressive shareholder returns, signaling a pivot

Via MarketMinute · February 10, 2026

As of February 10, 2026, the global energy landscape finds itself at a crossroads between the urgent demands of decarbonization and the immediate realities of energy security. At the heart of this tension stands BP p.l.c. (NYSE: BP, LSE: BP), a company that has spent the last five years attempting one of the most ambitious [...]

Via Finterra · February 10, 2026

In a move that signals the dawn of a new era for independent energy producers, Devon Energy (NYSE: DVN) and Coterra Energy (NYSE: CTRA) announced a definitive $21.4 billion all-stock merger on February 2, 2026. This transformative deal creates a "mega-independent" with a combined enterprise value of approximately $58

Via MarketMinute · February 9, 2026