Ford Motor (F)

13.59

+0.00 (0.00%)

NYSE · Last Trade: Feb 10th, 8:25 AM EST

U.S. stock futures rose on Tuesday following Monday’s positive close. Futures of major benchmark indices were higher. Investors are bracing for a heavy slate of data on Tuesday, headlined by a delayed data deluge of retail sales and employment costs that will serve as a critical compass for the Federal Reserve's interest rate path.

Via Benzinga · February 10, 2026

Chegg (CHGG) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 9, 2026

Ford's pivot away from electric vehicles puts a focus on profits, and less focus on growth. What will the company say in Q4 results?

Via Benzinga · February 9, 2026

Looking for the most active stocks in the S&P500 index on Monday?chartmill.com

Via Chartmill · February 9, 2026

In a dramatic reversal of fortune for the beleaguered electric vehicle sector, Polestar Automotive Holding UK PLC (NASDAQ: PSNY) saw its shares skyrocket by nearly 32% on Friday, February 6, 2026. The surge, which propelled the stock to a closing price of $19.42, marks the company’s most significant

Via MarketMinute · February 9, 2026

Tesla, Inc. (NASDAQ: TSLA) finds itself at a defining moment in its corporate history following the release of its Q4 2025 earnings report. As of February 9, 2026, the market is grappling with a paradox: Tesla’s core automotive deliveries fell by roughly 9% in 2025, yet its stock price

Via MarketMinute · February 9, 2026

Unhealthy automakers have a date with a nightmare scenario if Chinese EVs sell in the U.S. anytime soon. It's also a massive opportunity -- here's how.

Via The Motley Fool · February 9, 2026

Lucid depends on the Gravity SUV for near-term volume and is targeting a $50,000 midsize model and a robotaxi program with Uber and Nuro for longer-term growth.

Via Stocktwits · February 9, 2026

Automotive manufacturer Ford (NYSE:F)

will be reporting earnings this Tuesday after market hours. Here’s what to expect.

Via StockStory · February 8, 2026

While tariff complications and EV profitability will continue to weigh on bottom lines, this automaker is still driving strong results.

Via The Motley Fool · February 8, 2026

The tech and auto sectors saw major moves as Uber hit 200 million monthly users, Waymo faced scrutiny over remote guidance and a federal safety probe, Ford explored a partnership with Geely, and Tesla pushed for national self-driving regulations.

Via Benzinga · February 8, 2026

Ford is cutting its EV truck, and Rivian is about to launch a new one.

Via The Motley Fool · February 7, 2026

Given the scope of the automotive sector, investors might be interested in Ford.

Via The Motley Fool · February 7, 2026

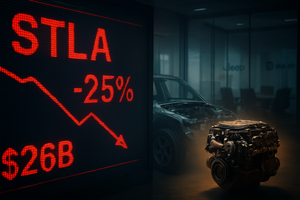

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

Investors were surprised by the cost of Stellantis's EV reset, and not in a good way.

Via The Motley Fool · February 6, 2026

Stellantis grapples with a monumental EV setback—one analyst calls it the "biggest capital allocation mistake" in auto history—joining peers in massive write-downs while its undervalued stock draws cautious analyst optimism.

Via Barchart.com · February 6, 2026

What's going on in today's session: S&P500 most active stockschartmill.com

Via Chartmill · February 6, 2026

Stellantis stock crashes as management announces a €22.2 billion ($26.5 billion) impairment charge. Here’s why STLA shares are not worth owning following the valuation haircut.

Via Barchart.com · February 6, 2026

GM's financial performance in 2025 cut through a lot of industry noise, and what investors need to hear is clear.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the North American energy landscape has reached a historic inflection point. The frantic merger and acquisition (M&A) wave that gripped the industry between 2023 and 2025 has largely transitioned into an intensive integration phase, fundamentally reshaping the sector into a more concentrated market dominated

Via MarketMinute · February 6, 2026

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction As of early 2026, Tesla (Nasdaq: TSLA) finds itself at the most critical juncture since the 2018 "Model 3 production hell." No longer just a high-growth electric vehicle manufacturer, Tesla is aggressively rebranding itself as a "Physical AI" and robotics powerhouse. This transition comes at a time when its core [...]

Via Finterra · February 6, 2026

Date: February 6, 2026 Introduction The high-stakes world of prestige beauty was sent into a tailspin yesterday as The Estée Lauder Companies Inc. (NYSE: EL) witnessed a dramatic 19.2% collapse in its share price. The sell-off, which represents one of the steepest single-day declines in the company’s nearly 80-year history, came on the heels of [...]

Via Finterra · February 6, 2026