Apple (AAPL)

261.73

-13.77 (-5.00%)

NASDAQ · Last Trade: Feb 12th, 6:51 PM EST

Business development company Sixth Street Specialty Lending (NYSE:TSLX) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 12.5% year on year to $108.2 million. Its non-GAAP profit of $0.30 per share was 40.4% below analysts’ consensus estimates.

Via StockStory · February 12, 2026

On February 12, 2026, the financial markets presented a stark dichotomy between fundamental corporate strength and cautious investor sentiment. While Apple Inc. (NASDAQ: AAPL) continues to ride the crest of a massive “AI supercycle” fueled by its latest iPhone 17 lineup, the broader market’s appetite for mega-cap technology stocks

Via MarketMinute · February 12, 2026

Online accommodations platform Airbnb (NASDAQ:ABNB) announced better-than-expected revenue in Q4 CY2025, with sales up 12% year on year to $2.78 billion. Guidance for next quarter’s revenue was optimistic at $2.61 billion at the midpoint, 3% above analysts’ estimates. Its GAAP profit of $0.56 per share was 15.6% below analysts’ consensus estimates.

Via StockStory · February 12, 2026

The Invesco QQQ is one of the most popular ETFs on the market. But is it the best growth-oriented ETF?

Via The Motley Fool · February 12, 2026

The U.S. labor market threw a curveball at Wall Street on Wednesday, February 11, 2026, as the January Jobs Report revealed a surprising burst of hiring that fundamentally reshaped the outlook for interest rate cuts this year. Nonfarm payrolls surged by 130,000, nearly doubling the consensus estimate of

Via MarketMinute · February 12, 2026

Apple could be following an important playbook that Netflix led the way in years ago as it transformed its streaming platform.

Via Benzinga · February 12, 2026

Online travel agency Expedia (NASDAQ:EXPE) announced better-than-expected revenue in Q4 CY2025, with sales up 11.4% year on year to $3.55 billion. On top of that, next quarter’s revenue guidance ($3.35 billion at the midpoint) was surprisingly good and 3.7% above what analysts were expecting. Its non-GAAP profit of $3.78 per share was 12.2% above analysts’ consensus estimates.

Via StockStory · February 12, 2026

Social commerce platform Pinterest (NYSE: PINS) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 14.3% year on year to $1.32 billion. Next quarter’s revenue guidance of $961 million underwhelmed, coming in 2.1% below analysts’ estimates. Its non-GAAP profit of $0.67 per share was in line with analysts’ consensus estimates.

Via StockStory · February 12, 2026

Pet insurance provider Trupanion (NASDAQ:TRUP) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.7% year on year to $376.9 million. Its GAAP profit of $0.13 per share was 19.6% below analysts’ consensus estimates.

Via StockStory · February 12, 2026

This AI chip kingpin seems like a better investment than Nvidia.

Via The Motley Fool · February 12, 2026

VXUS is an easy way to gain exposure to overseas markets.

Via The Motley Fool · February 12, 2026

As the final results of the Q4 2025 earnings season trickle in this February 12, 2026, the S&P 500 has managed to navigate a treacherous path of high expectations and a tightening monetary narrative. Despite initial fears that high interest rates and a cooling labor market would erode corporate

Via MarketMinute · February 12, 2026

In a stunning reversal for one of 2025’s top market performers, AppLovin (NASDAQ: APP) saw its shares crater by 20% following its fourth-quarter earnings report on February 11, 2026. Despite posting "beat-and-raise" results that exceeded Wall Street’s expectations for both revenue and earnings, the Palo Alto-based software company

Via MarketMinute · February 12, 2026

The narrative around OpenAI has completely flipped, challenging Oracle's justification of borrowing money to fund artificial intelligence (AI) investments.

Via The Motley Fool · February 12, 2026

Wall Street reached a monumental psychological and financial peak on January 28, 2026, when the S&P 500 Index surged to an all-time intraday high of 7,002.28. This historic breach marks the first time the benchmark index has ever crossed the 7,000 threshold, crowning a relentless 14-month

Via MarketMinute · February 12, 2026

Tech giants erased $500B on Thursday as Cisco's weak margin outlook and memory shortages deepened the sector's AI-driven selloff.

Via Benzinga · February 12, 2026

TEMPE, AZ — February 12, 2026 — Amkor Technology (NASDAQ:AMKR) has sent shockwaves through the semiconductor industry this week, reporting a fourth-quarter earnings blowout that far exceeded even the most optimistic Wall Street projections. The company posted an earnings per share (EPS) of $0.69, a staggering 60% surprise over the

Via MarketMinute · February 12, 2026

Shares of semiconductor maker Himax Technologies (NASDAQ:HIMX) fell 9% in the morning session after its fourth-quarter 2025 earnings report revealed significant weakness despite beating revenue expectations.

Via StockStory · February 12, 2026

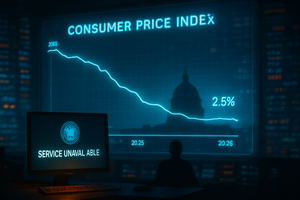

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

As the first quarter of 2026 unfolds, the technology sector is asserting its dominance with a vigor that has caught even the most optimistic market spectators by surprise. Following a two-year period characterized by what analysts described as a "necessary digestion" of the explosive gains from the early 2020s, the

Via MarketMinute · February 12, 2026

LONDON/NEW YORK – In a historic shift that has redefined the global financial landscape, gold has decisively breached the $5,000 per ounce milestone for the first time in history. As of February 12, 2026, the yellow metal sits at $4,985, having briefly peaked at a staggering $5,608

Via MarketMinute · February 12, 2026

TSMC will remain a bellwether of the booming AI market.

Via The Motley Fool · February 12, 2026

The financial world witnessed a watershed moment on January 28, 2026, as the S&P 500 index breached the 7,000-point threshold for the first time in history. This milestone, coming just fourteen months after the index crossed the 6,000 mark in November 2024, underscores the relentless momentum of

Via MarketMinute · February 12, 2026

Apple stock fell on reports that the company will delay the release of its AI-powered Siri until May, with some features pushed to the fall.

Via Investor's Business Daily · February 12, 2026

In a resounding display of market dominance, shares of Spotify (NYSE: SPOT) surged 14.7% this week, closing at $476.02 after the company released a blockbuster fourth-quarter 2025 earnings report. The rally, which added billions to the company’s market capitalization, was fueled by record-breaking user acquisition and a

Via MarketMinute · February 12, 2026