Latest News

Growth stocks can be a valuable addition to any long-term investor's portfolio.

Via The Motley Fool · December 28, 2025

AGNC Investment's dividend yield is more than twice as large as Realty Income's, but the lower yield could still be the better choice.

Via The Motley Fool · December 28, 2025

SMR nuclear stocks may use uranium for energy in the future -- but they're burning cash already today.

Via The Motley Fool · December 28, 2025

One of the country's most influential policymakers has a subtle warning, backed by historical precedent, for investors.

Via The Motley Fool · December 28, 2025

Here's how Ford's pivot away from EVs, and introduction of a new business, works out for investors.

Via The Motley Fool · December 28, 2025

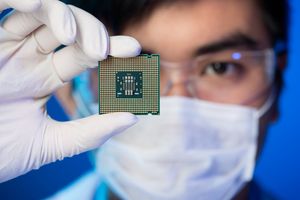

This week was buzzing with tech news, from Italy's antitrust authority taking on Meta Platforms, Inc. to Samsung Electronics Co., Ltd. gearing up to launch its first in-house mobile GPU.

Via Benzinga · December 28, 2025

Taiwan Semiconductor appears to be a popular stock among some billionaire investors.

Via The Motley Fool · December 28, 2025

A look at the performance of the S&P 500, the Nasdaq Composite, and gold, silver, and platinum since the current bull market for stocks began on 10/12/22.

Via Talk Markets · December 28, 2025

York Water commands massive respect for its dedication to rewarding shareholders, but I'd prefer this other royal choice.

Via The Motley Fool · December 28, 2025

Via Benzinga · December 28, 2025

Gold markets have rallied again during the previous week, as we have broken above the $4500 level. I think this is a situation where anytime you get the opportunity for a short-term pullback to take advantage of, you simply must do so.

Via Talk Markets · December 28, 2025

Investing in value-driven stocks can be a wise strategy for any long-term investor.

Via The Motley Fool · December 28, 2025

Stocks may fluctuate, but this dividend continues to move in one direction.

Via The Motley Fool · December 28, 2025

Rocket Lab, Micron, Sandisk, and CoreWeave led last week's large-cap rally—alongside Lumentum, Venture Global, Astera Labs, BioMarin, Ciena, and Karman—on a mix of launch milestones, analyst upgrades, and AI/semiconductor momentum.

Via Benzinga · December 28, 2025

There have been some big losers in the market in 2025.

Via The Motley Fool · December 28, 2025

WTI Crude Oil should begin tomorrow’s trading with red warning signs flashing as a reminder for day traders looking to pursue the commodity.

Via Talk Markets · December 28, 2025

If history is any guide, it's time to buy the dip on Bitcoin yet again.

Via The Motley Fool · December 28, 2025

Last week's big large-cap laggards were led by Brown-Forman, Carvana, and Stellantis, with Starbucks, Samsara, Ryan Specialty, PepsiCo, Texas Pacific Land, On Holding, and General Mills also sliding on analyst actions, labor unrest, and regulatory concerns.

Via Benzinga · December 28, 2025

The retiring investor says a lot with his actions during times of market froth.

Via The Motley Fool · December 28, 2025

Delaying benefits is the right move for most people.

Via The Motley Fool · December 28, 2025

The S&P 500 is only days away from making history. And it could be a good indicator of what's to come.

Via The Motley Fool · December 28, 2025

This weekend in tech and markets: Apple launches a $200 "iPhone Sock," Tim Cook buys $3 million in Nike shares, and new AI wearables.

Via Benzinga · December 28, 2025

Alphabet and Amazon are genius stocks to buy right now.

Via The Motley Fool · December 28, 2025

The announcement will freeze the development of five major projects along the U.S. East Coast, representing nearly 6 GW of energy, that were set to enter commercial operation over the next 2 years.

Via Talk Markets · December 28, 2025

It's not about math. It's about mindset.

Via The Motley Fool · December 28, 2025