Kinsale Capital Group has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 6.2% to $457.45 per share while the index has gained 10.5%.

Is KNSL a buy right now? Find out in our full research report, it’s free.

Why Is Kinsale Capital Group a Good Business?

Founded in 2009 during the aftermath of the financial crisis when many insurers were retreating from riskier markets, Kinsale Capital Group (NYSE:KNSL) is an insurance company that specializes in writing policies for hard-to-place, unusual, or high-risk businesses that standard insurers typically avoid.

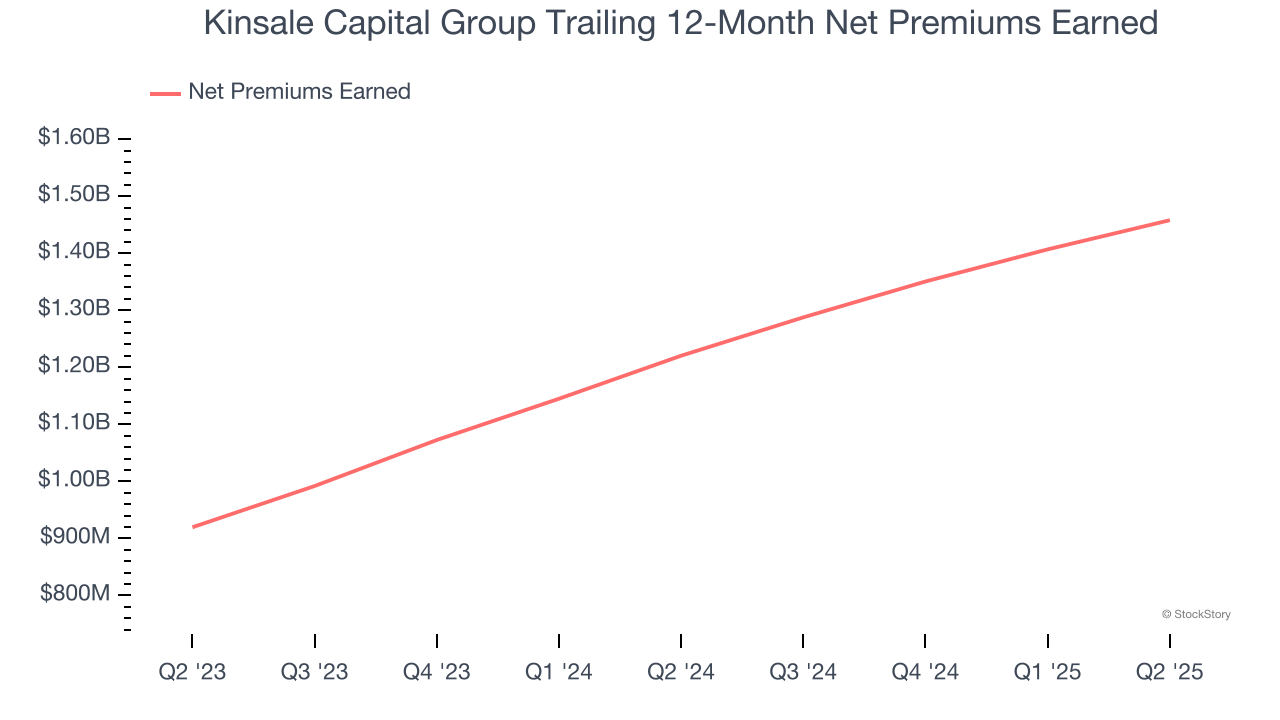

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Kinsale Capital Group’s net premiums earned has grown at a 25.9% annualized rate over the last two years, much better than the broader insurance industry.

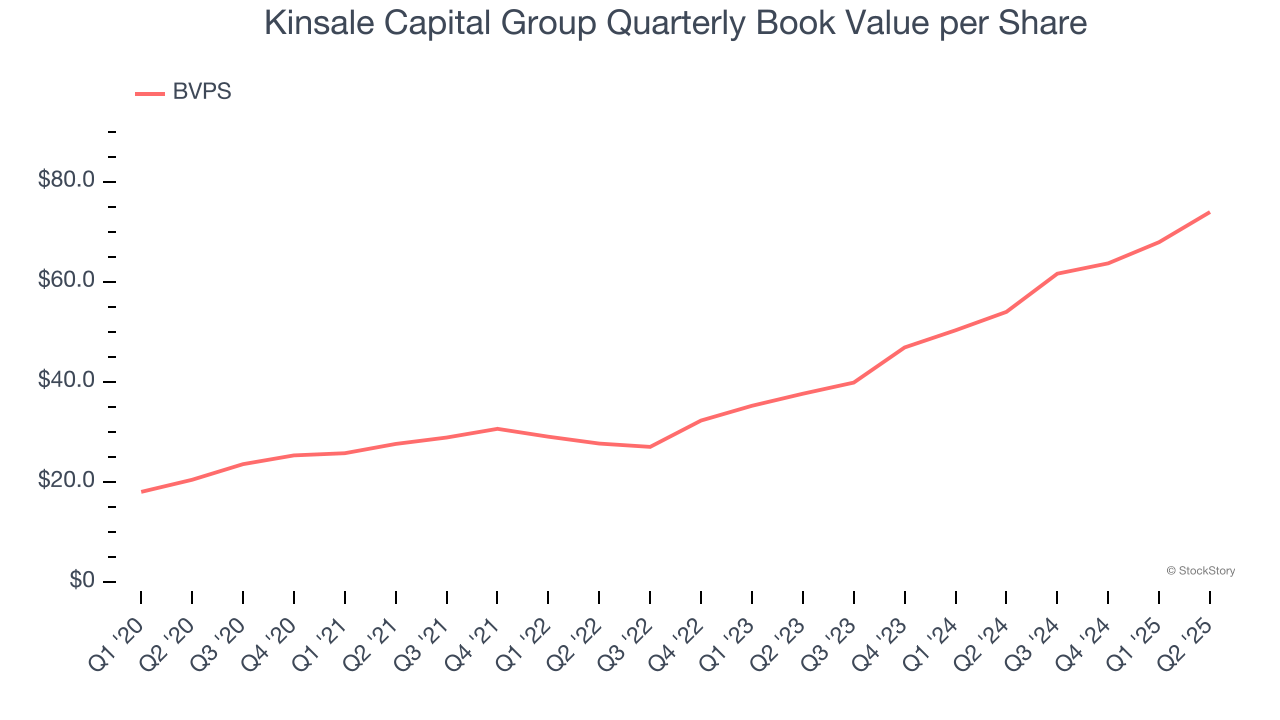

2. Growing BVPS Reflects Strong Asset Base

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Kinsale Capital Group’s BVPS increased by 29.3% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 40.2% annual clip over the past two years (from $37.64 to $73.93 per share).

3. Projected BVPS Growth Is Remarkable

Book value per share (BVPS) growth is driven by an insurer’s ability to earn consistent underwriting profits while generating strong investment returns.

Over the next 12 months, Consensus estimates call for Kinsale Capital Group’s BVPS to grow by 25.5% to $75.02, elite growth rate.

Final Judgment

These are just a few reasons why we think Kinsale Capital Group is an elite insurance company, but at $457.45 per share (or 5.6× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Kinsale Capital Group

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.