Electronics distributor Richardson Electronics (NASDAQ:RELL) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 9.5% year on year to $51.89 million. Its non-GAAP profit of $0.12 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Richardson Electronics? Find out by accessing our full research report, it’s free.

Richardson Electronics (RELL) Q2 CY2025 Highlights:

- Revenue: $51.89 million vs analyst estimates of $53.86 million (9.5% year-on-year growth, 3.7% miss)

- Adjusted EPS: $0.12 vs analyst estimates of $0.05 (significant beat)

- Adjusted EBITDA: $3.09 million vs analyst estimates of $1.93 million (5.9% margin, 60.4% beat)

- Operating Margin: 1.2%, up from -0.2% in the same quarter last year

- Backlog: $134.2 million at quarter end

- Market Capitalization: $138.9 million

Company Overview

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Revenue Growth

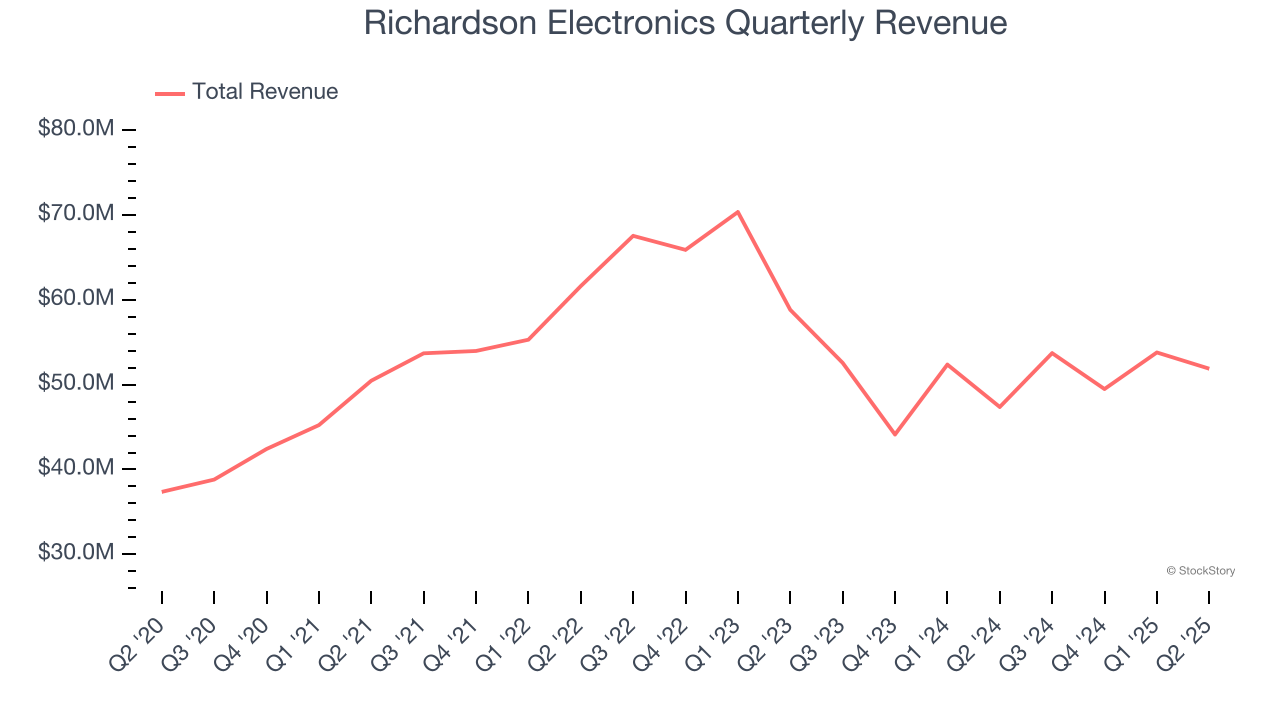

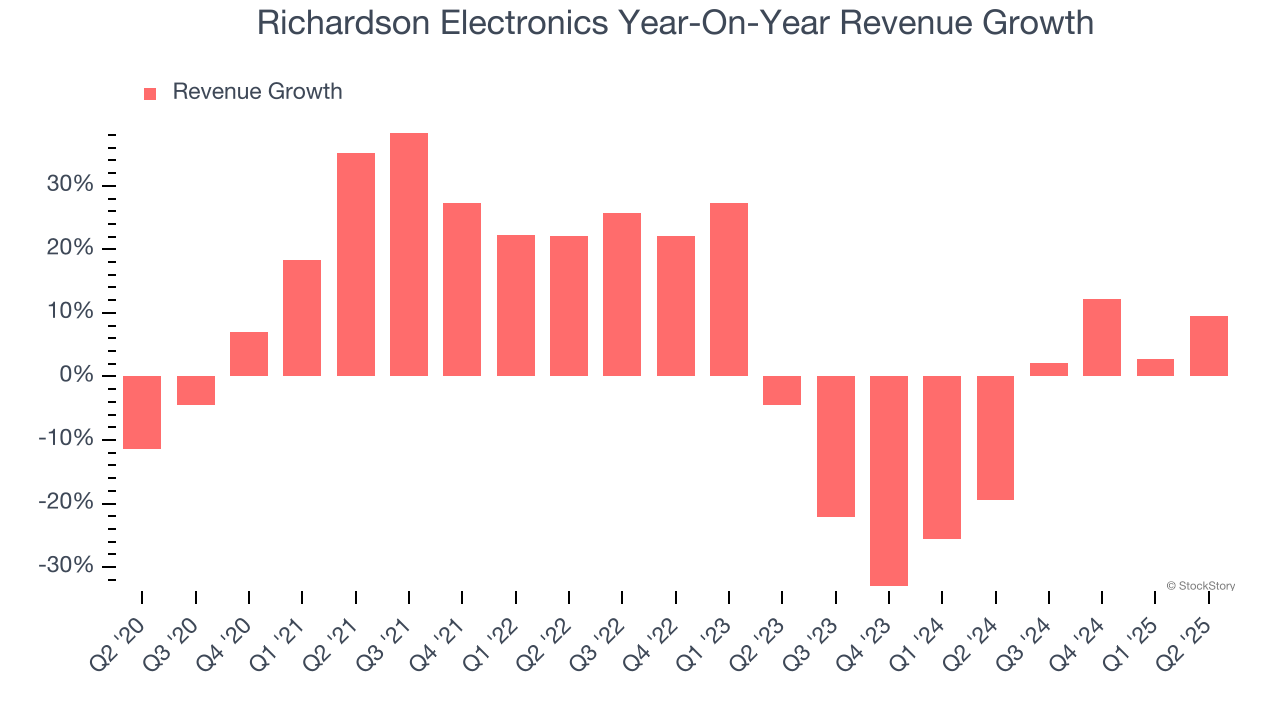

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Richardson Electronics’s sales grew at a mediocre 6% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Richardson Electronics’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.8% annually.

This quarter, Richardson Electronics’s revenue grew by 9.5% year on year to $51.89 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

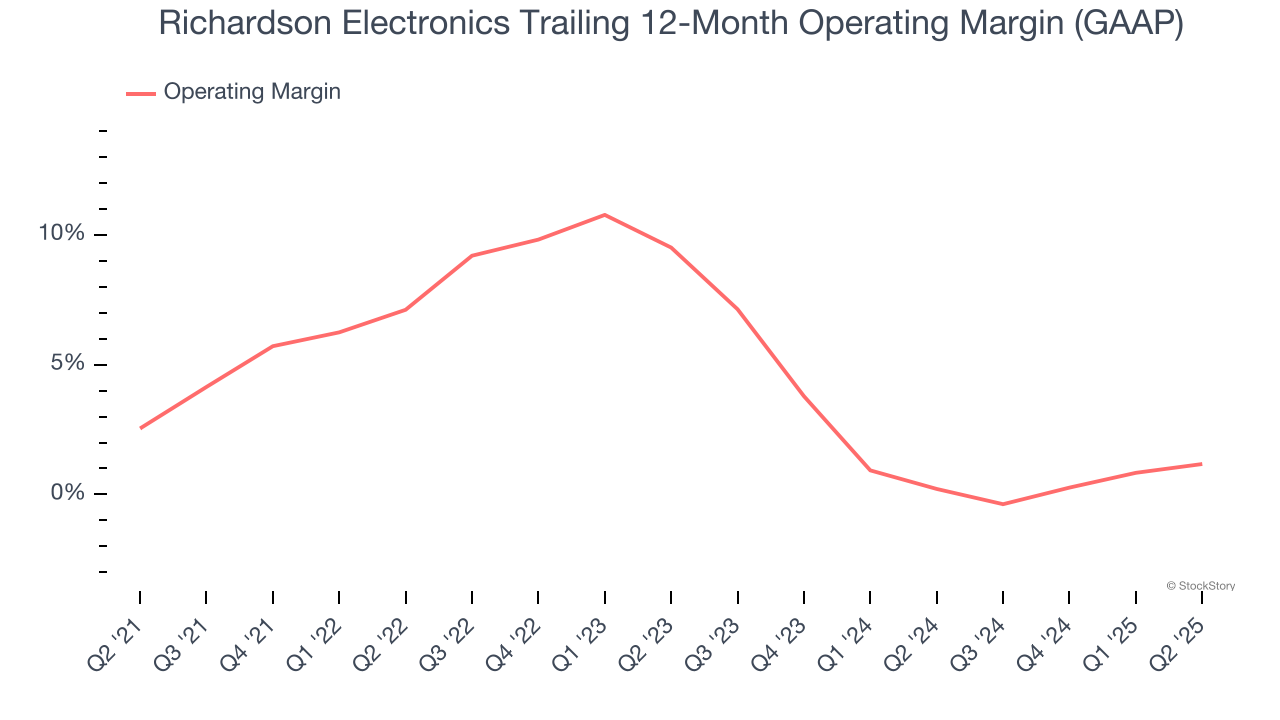

Richardson Electronics was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for an industrials business.

Analyzing the trend in its profitability, Richardson Electronics’s operating margin decreased by 1.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Richardson Electronics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, Richardson Electronics generated an operating margin profit margin of 1.2%, up 1.5 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

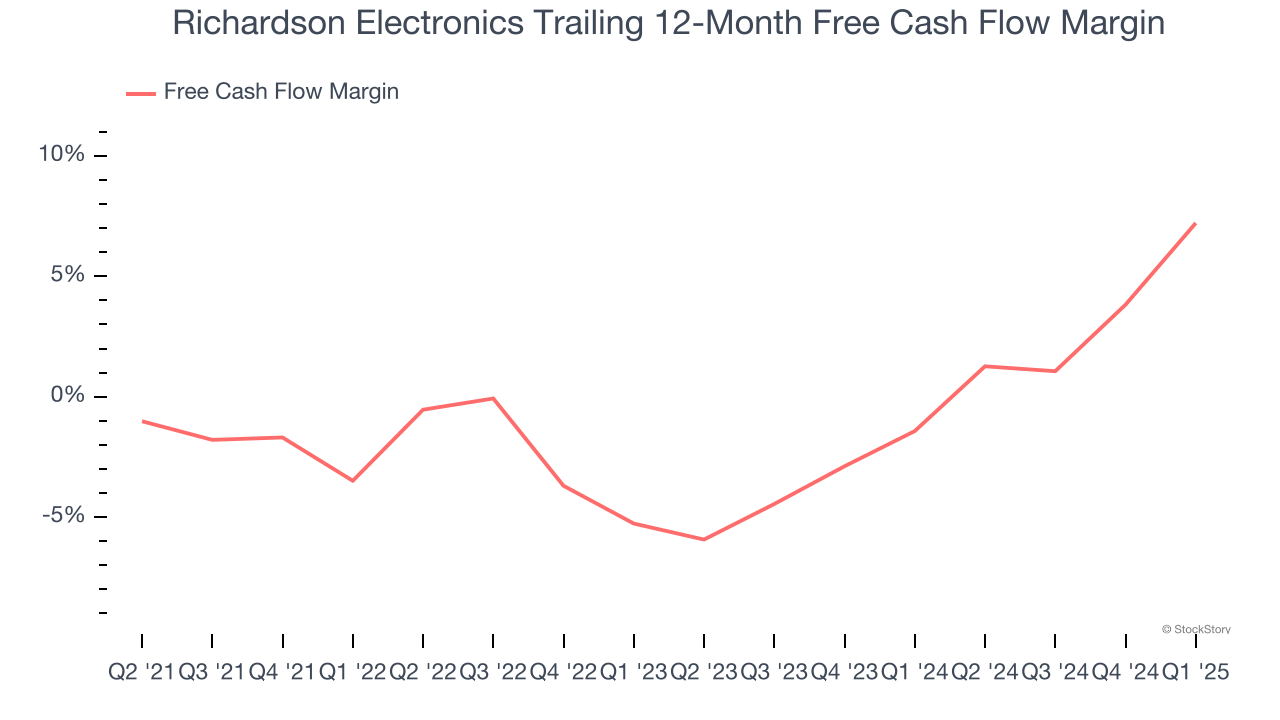

Richardson Electronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Richardson Electronics’s margin expanded by 3.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Key Takeaways from Richardson Electronics’s Q2 Results

We were impressed by how significantly Richardson Electronics blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed. Overall, we think this was a decent quarter with some key metrics above expectations. The market seemed to be hoping for more, and the stock traded down 2% to $9.59 immediately following the results.

Big picture, is Richardson Electronics a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.