Medical technology company Inspire Medical Systems (NYSE:INSP) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 10.5% year on year to $224.5 million. The company expects the full year’s revenue to be around $905 million, close to analysts’ estimates. Its GAAP profit of $0.34 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Inspire Medical Systems? Find out by accessing our full research report, it’s free for active Edge members.

Inspire Medical Systems (INSP) Q3 CY2025 Highlights:

- Revenue: $224.5 million vs analyst estimates of $220.2 million (10.5% year-on-year growth, 1.9% beat)

- EPS (GAAP): $0.34 vs analyst estimates of -$0.19 (significant beat)

- Adjusted EBITDA: $44.01 million vs analyst estimates of $24.72 million (19.6% margin, 78% beat)

- The company reconfirmed its revenue guidance for the full year of $905 million at the midpoint

- EPS (GAAP) guidance for the full year is $0.95 at the midpoint, beating analyst estimates by 67.2%

- Operating Margin: 4.3%, down from 7% in the same quarter last year

- Market Capitalization: $2.13 billion

“The Inspire team had a very productive third quarter focusing on the transition to the Inspire V system while delivering very strong results globally,” said Tim Herbert, Chairman and Chief Executive Officer of Inspire Medical Systems.

Company Overview

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE:INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

Revenue Growth

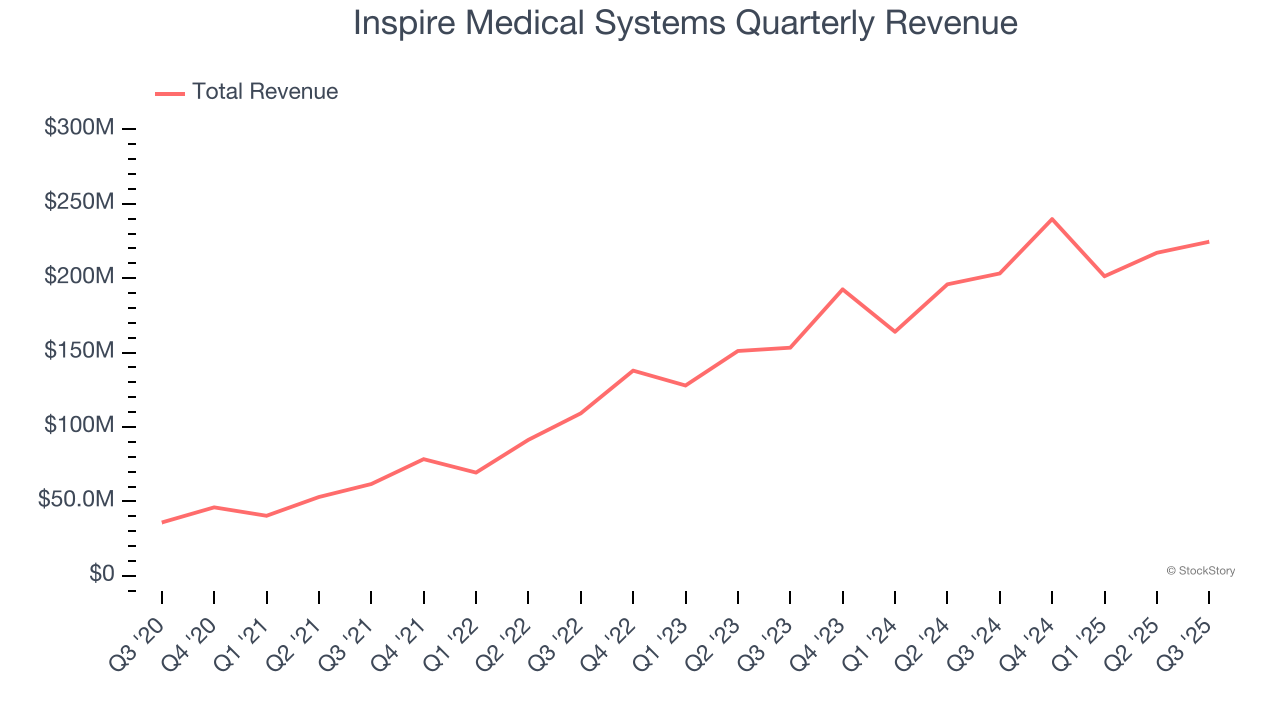

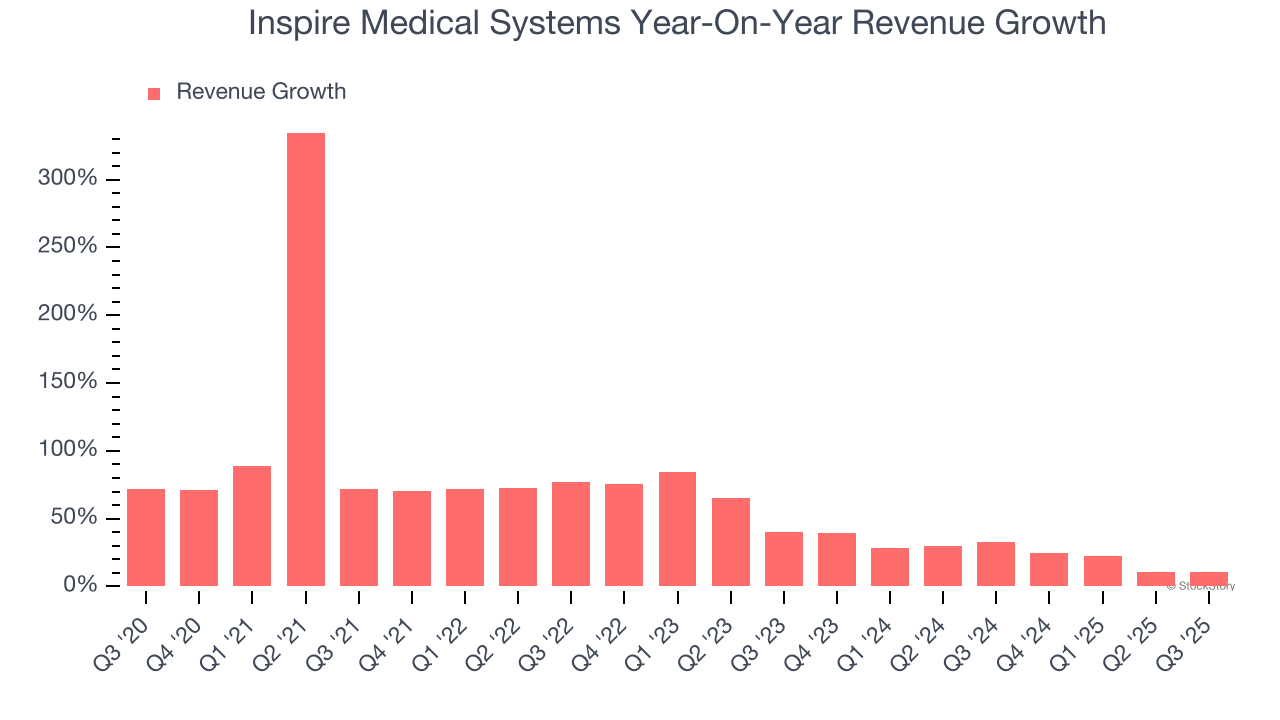

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Inspire Medical Systems’s sales grew at an incredible 55.8% compounded annual growth rate over the last five years. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Inspire Medical Systems’s annualized revenue growth of 24.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Inspire Medical Systems reported year-on-year revenue growth of 10.5%, and its $224.5 million of revenue exceeded Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 13.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and indicates the market is forecasting success for its products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

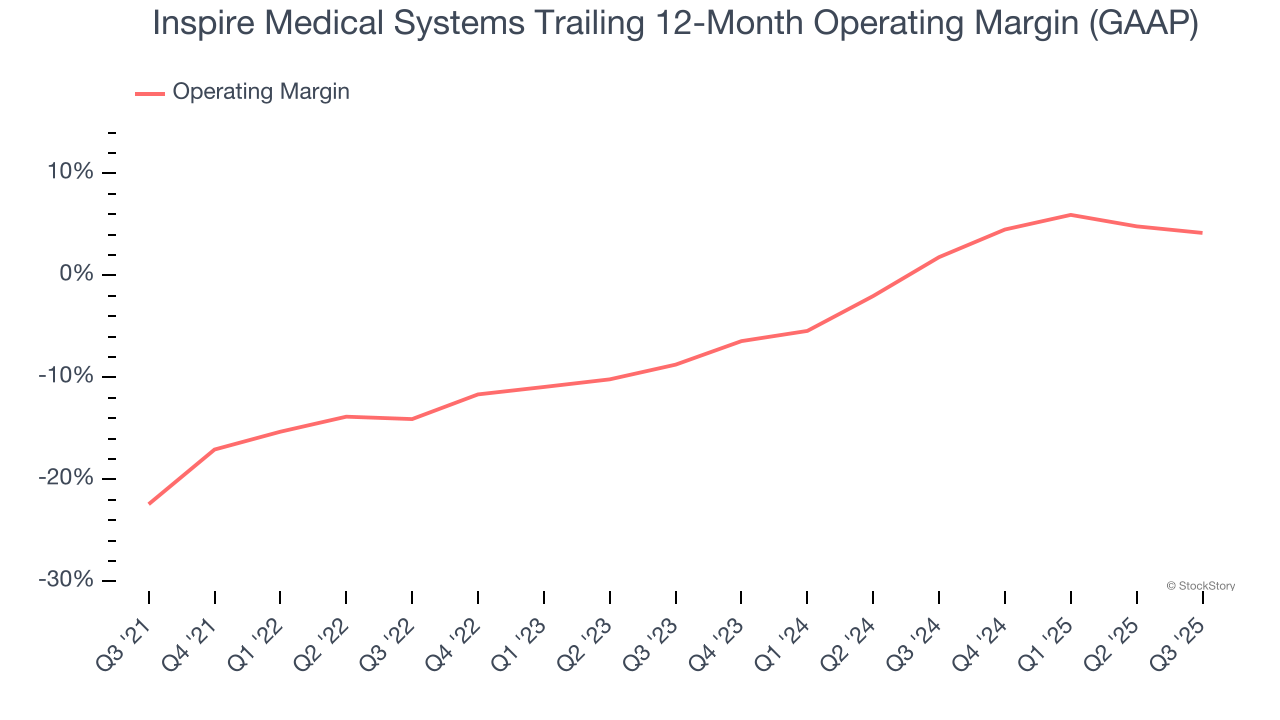

Although Inspire Medical Systems was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Inspire Medical Systems’s operating margin rose by 26.6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 12.9 percentage points on a two-year basis.

In Q3, Inspire Medical Systems generated an operating margin profit margin of 4.3%, down 2.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

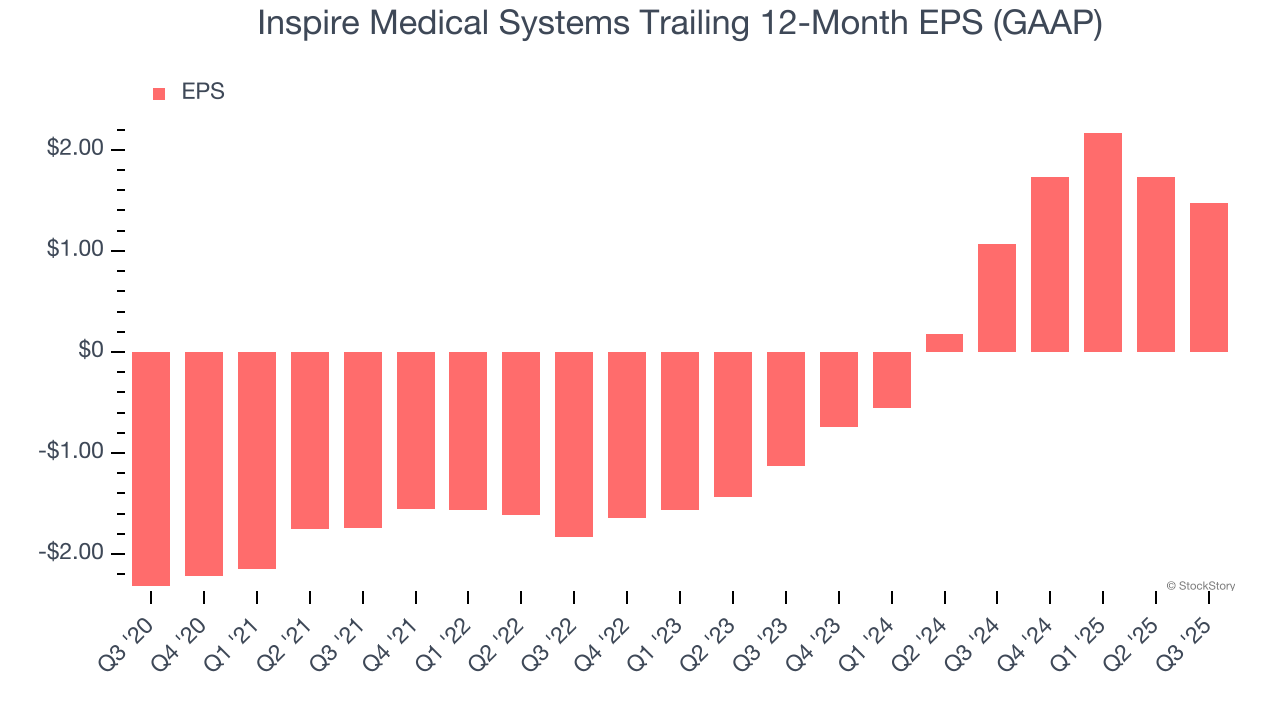

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Inspire Medical Systems reported EPS of $0.34, down from $0.60 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Inspire Medical Systems’s full-year EPS of $1.47 to shrink by 13.8%.

Key Takeaways from Inspire Medical Systems’s Q3 Results

It was good to see Inspire Medical Systems beat analysts’ revenue and EPS expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside, especially after a weak quarter in Q2 that saw guidance massively lowered. This could be a first step in stabilization of the business and the stock, and shares traded up 9.3% to $80.50 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.