Plant-based protein company Beyond Meat (NASDAQ:BYND) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 13.3% year on year to $70.22 million. On the other hand, next quarter’s revenue guidance of $62.5 million was less impressive, coming in 11.9% below analysts’ estimates. Its non-GAAP loss of $0.47 per share was 8.9% below analysts’ consensus estimates.

Is now the time to buy Beyond Meat? Find out by accessing our full research report, it’s free for active Edge members.

Beyond Meat (BYND) Q3 CY2025 Highlights:

- Beyond Meat delayed filing its 10-Q for its fiscal quarter ended September 27, 2025. As previously disclosed on Form 8-K filed on October 24, 2025, the Company expects to record a non-cash impairment charge related to certain of its long-lived assets in the three months ended September 27, 2025.

- Revenue: $70.22 million vs analyst estimates of $68.77 million (13.3% year-on-year decline, 2.1% beat)

- Adjusted EPS: -$0.47 vs analyst expectations of -$0.43 (8.9% miss)

- Adjusted EBITDA: -$21.63 million vs analyst estimates of -$18.94 million (-30.8% margin, 14.2% miss)

- Revenue Guidance for Q4 CY2025 is $62.5 million at the midpoint, below analyst estimates of $70.97 million

- Operating Margin: -160%, down from -38.2% in the same quarter last year

- Free Cash Flow was -$41.69 million compared to -$24.07 million in the same quarter last year

- Sales Volumes fell 10.3% year on year (-12.6% in the same quarter last year)

- Market Capitalization: $546.1 million

Company Overview

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company specializing in alternatives to traditional meat products.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $290.6 million in revenue over the past 12 months, Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

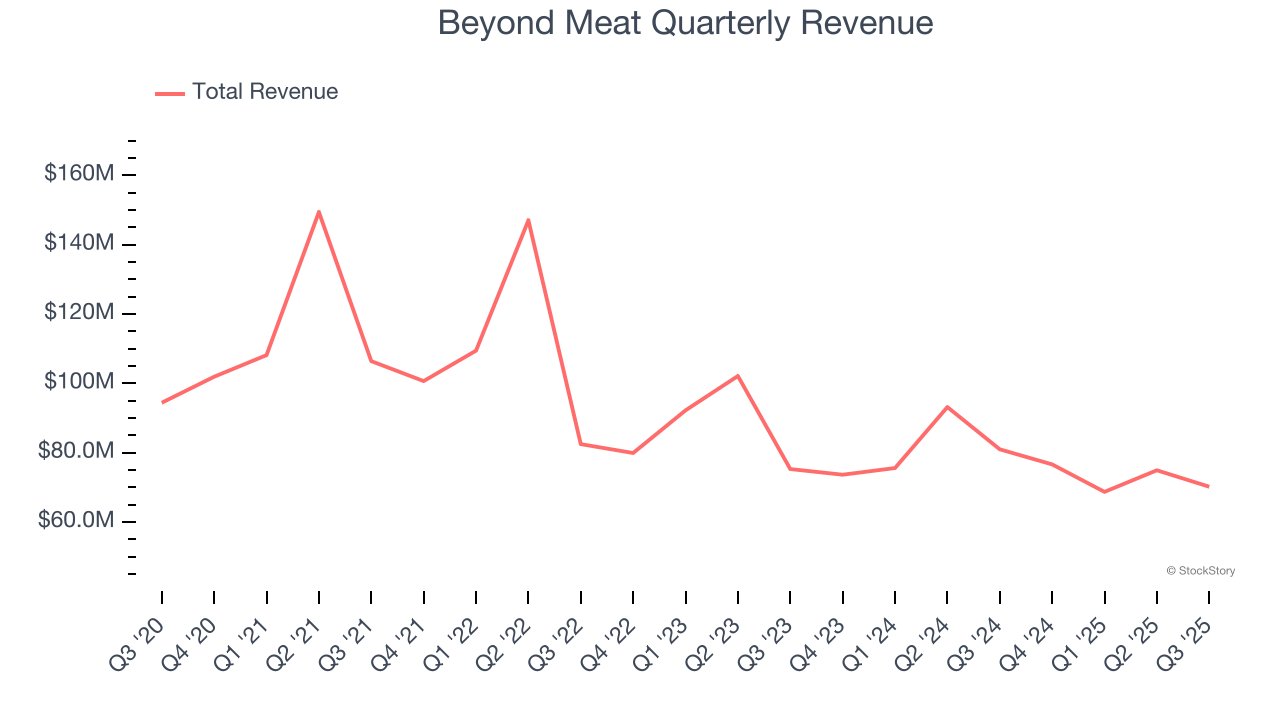

As you can see below, Beyond Meat struggled to generate demand over the last three years. Its sales dropped by 12.9% annually as consumers bought less of its products.

This quarter, Beyond Meat’s revenue fell by 13.3% year on year to $70.22 million but beat Wall Street’s estimates by 2.1%. Company management is currently guiding for a 18.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.9% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

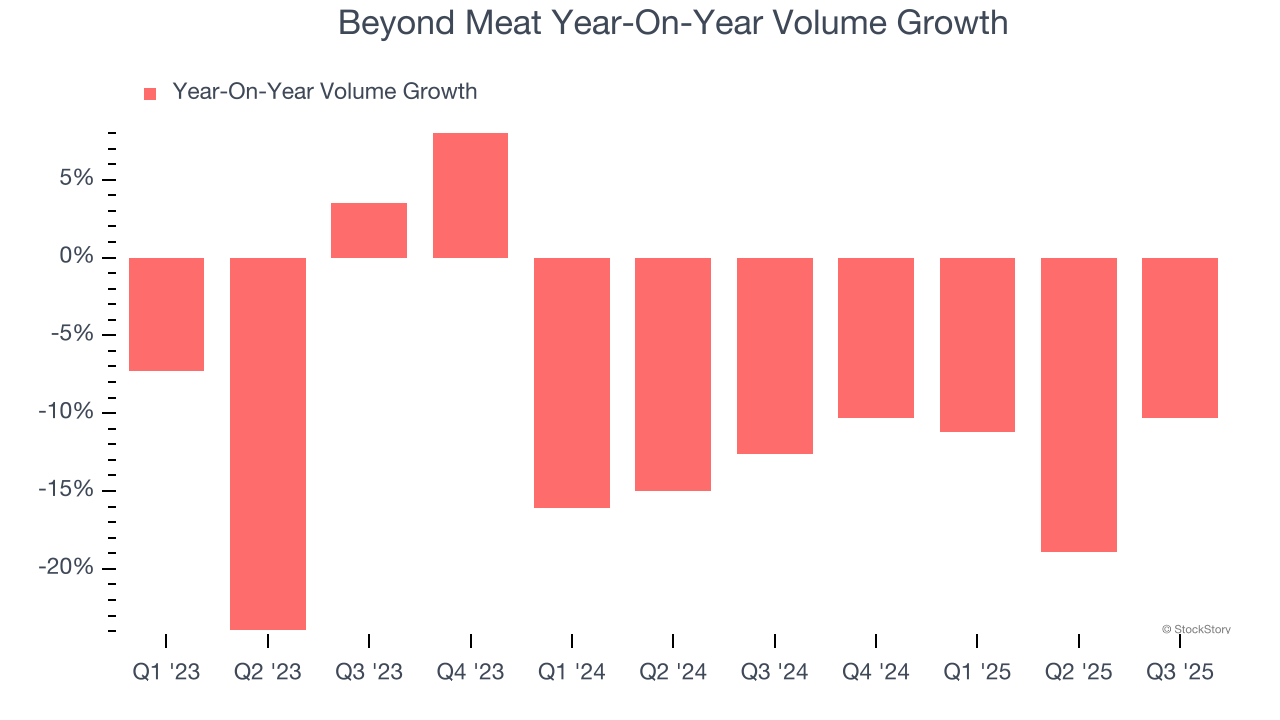

Beyond Meat’s average quarterly sales volumes have shrunk by 10.8% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Beyond Meat’s Q3 2025, sales volumes dropped 10.3% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from Beyond Meat’s Q3 Results

It was encouraging to see Beyond Meat beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.3% to $1.30 immediately after reporting.

Beyond Meat’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.