Bethesda, Maryland-based Marriott International, Inc. (MAR), with a market capitalization of around $87.5 billion, is one of the most expansive names in global hospitality. The company operates and franchises an expansive portfolio of hotels, resorts, and lodging properties worldwide, with its footprint spanning over 9,400 properties across 144 countries and territories, giving Marriott unmatched scale and reach.

Its portfolio is deliberately diverse, covering the full spectrum of travel needs – from luxury brands such as The Ritz-Carlton, JW Marriott, and Bulgari Hotels & Resorts to well-known mid-scale and value offerings like Courtyard by Marriott and Fairfield Inn & Suites. Beyond traditional hotels, Marriott also maintains a strong presence in timeshare, residential, and extended-stay accommodations, reinforcing its position as a comprehensive hospitality platform serving both leisure and business travelers worldwide.

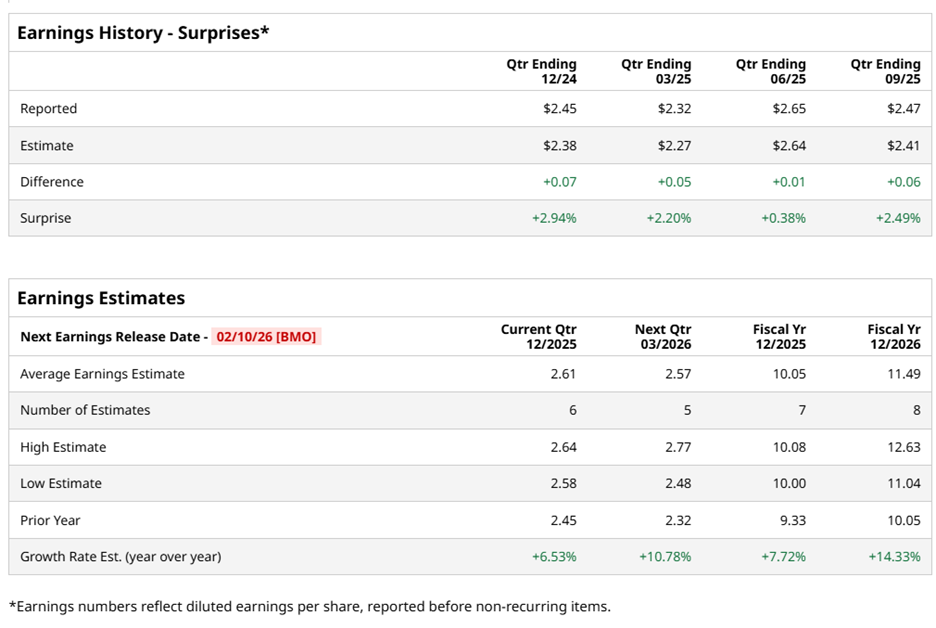

The global hospitality company is expected to release its Q4 2025 earnings report next month on Tuesday, Feb. 10, before the market opens. Expectations are already leaning positive. Wall Street anticipates earnings coming in at $2.61 per share, representing an increase of 6.5% from $2.45 per share reported in the same quarter last year. What’s adding to the optimism is consistency – Marriott has beaten earnings estimates in each of the past four quarters, building credibility with the market.

For full-year fiscal 2025, analysts expect EPS of $10.05, a solid 7.7% jump from $9.33 reported in fiscal 2024. And the momentum does not seem to stop there, with fiscal 2026 EPS projected to climb another 14.3% year over year (YoY) to $11.49.

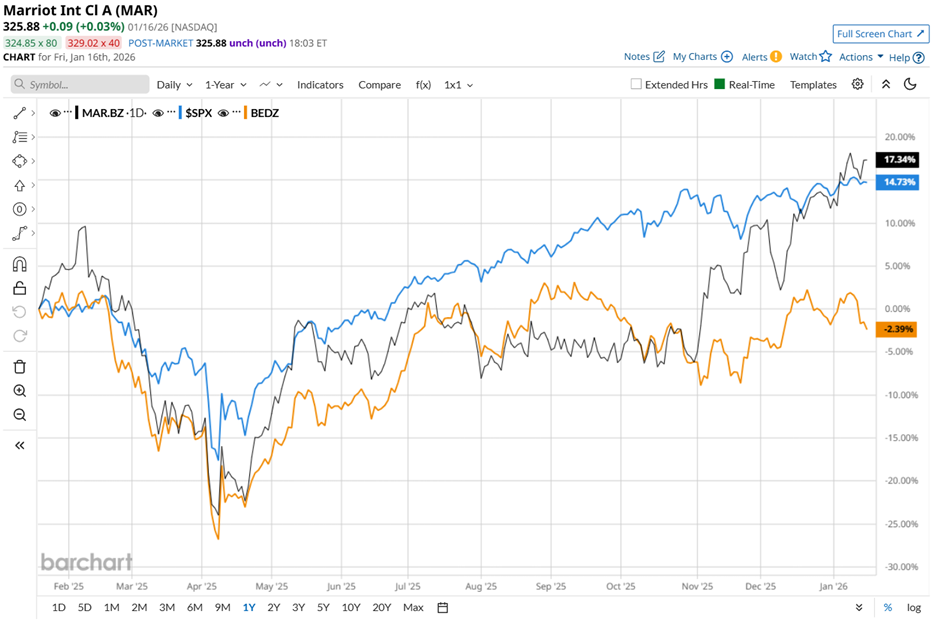

The stock performance mirrors that confidence. MAR has surged 18.1% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 16.9% rise and surpassing the AdvisorShares Hotel ETF’s (BEDZ) 1.3% fall over the same time frame.

Marriott’s shares have been on a smooth run, and the reason is pretty simple – it is in the right place at the right time. Travel is back, the world packed its bags again, and the hospitality giant outpaced the broader market, hitting an all-time high of $331.09 in January, catching the market’s full attention.

What’s really working in Marriott’s favor is its tilt toward luxury and premium travelers. These guests are not cutting back much, even when budgets get tight. That showed up in the latest quarter. After posting stronger-than-expected Q3 results in November, the stock jumped 3.2%. Revenue rose to $6.5 billion, while luxury hotels continued to perform well, especially overseas.

Even as lower-end hotels softened in North America, higher-end properties held firm. Profits followed, with adjusted EPS beating expectations. Putting it all together – strong travel demand, resilient luxury customers, and solid execution – and it is easy to see why investors have stayed upbeat on Marriott.

Analysts’ consensus opinion on the stock is moderately optimistic, with a “Moderate Buy” rating overall. Among the 26 analysts covering the stock, 10 are recommending a “Strong Buy,” two advise a “Moderate Buy,” 13 are on the sidelines with a “Hold,” and the remaining one analyst gives a “Strong Sell” for the stock.

Although MAR’s stellar rally has pushed its stock above the average analyst price target of $309.68, the Street-high target of $370 implies 13.5% upside potential from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart