Humana Inc. (HUM) is a health insurance and managed care company that provides a wide range of medical and specialty insurance products, including Medicare Advantage plans, Medicaid, commercial fully-insured health benefits, pharmacy services, and care delivery. The company, headquartered in Louisville, Kentucky, operates across the United States and is one of the largest health insurers in the country. Humana’s market cap is roughly $32.9 billion.

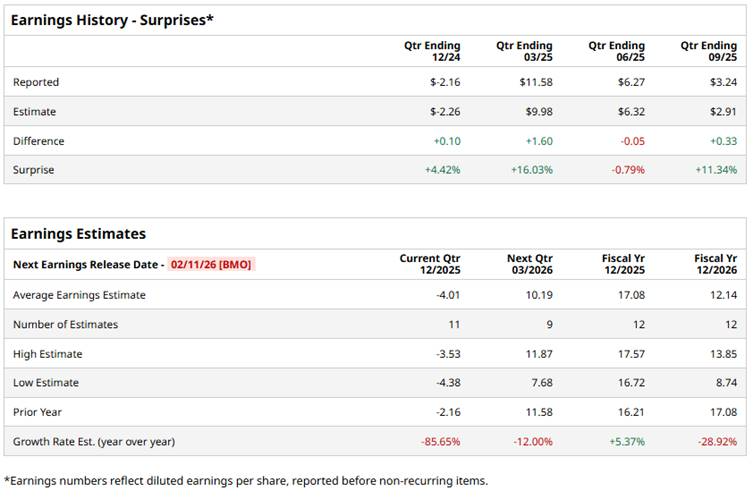

The company is scheduled to announce its fiscal Q4 earnings for 2025 before the market opens on Feb. 11. Ahead of this event, analysts expect this health insurance company to report a loss of $4.01 per share, deteriorating 85.7% from $2.16 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on one occasion.

For fiscal 2025, analysts expect HUM to report a profit of $17.08 per share, up 5.4% from $16.21 per share in fiscal 2024. However, its EPS is expected to decline by 28.9% year-over-year to $12.14 in fiscal 2026.

HUM has lagged behind the S&P 500 Index’s ($SPX) 16.9% return and the State Street SPDR S&P Health Care Services ETF’s (XHS) 15% gains over the past 52 weeks, with its shares down marginally over the same time frame.

HUM has demonstrated a weak performance primarily due to ongoing challenges in its Medicare Advantage business. The most significant factor was a substantial downgrade in the quality ratings (Star Ratings) for several of its major MA plans. Additionally, the company has faced higher-than-anticipated medical costs, which have pressured profit margins.

For Q3 2025 (reported on Nov. 5), while revenues rose 11.1% year-over-year (YOY) to $32.7 billion, profits weakened as rising medical utilization pushed the adjusted benefit ratio up to 91.1%. Non-GAAP EPS fell 22.1% YOY to $3.24. Humana also continues to face Medicare Advantage pressures, with expected membership losses of 425K for 2025. The company reaffirmed its 2025 benefit ratio and adjusted EPS guidance of $17, but it lowered its GAAP EPS outlook to $12.26.

Wall Street analysts are moderately optimistic about HUM, with an overall “Moderate Buy” rating. Among 27 analysts covering the stock, seven recommend “Strong Buy,” two indicate “Moderate Buy,” 16 suggest “Hold,” and two advise a “Strong Sell” rating. Its mean price target of $286.50 indicates an upside potential of 4.8%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart