New York-based Consolidated Edison, Inc. (ED) is a utility company that provides electricity, natural gas, and steam to residential, commercial, and industrial customers. Valued at a market cap of $37.5 billion, the company is ready to announce its fiscal Q4 earnings for 2025 after the market closes on Thursday, Feb. 19.

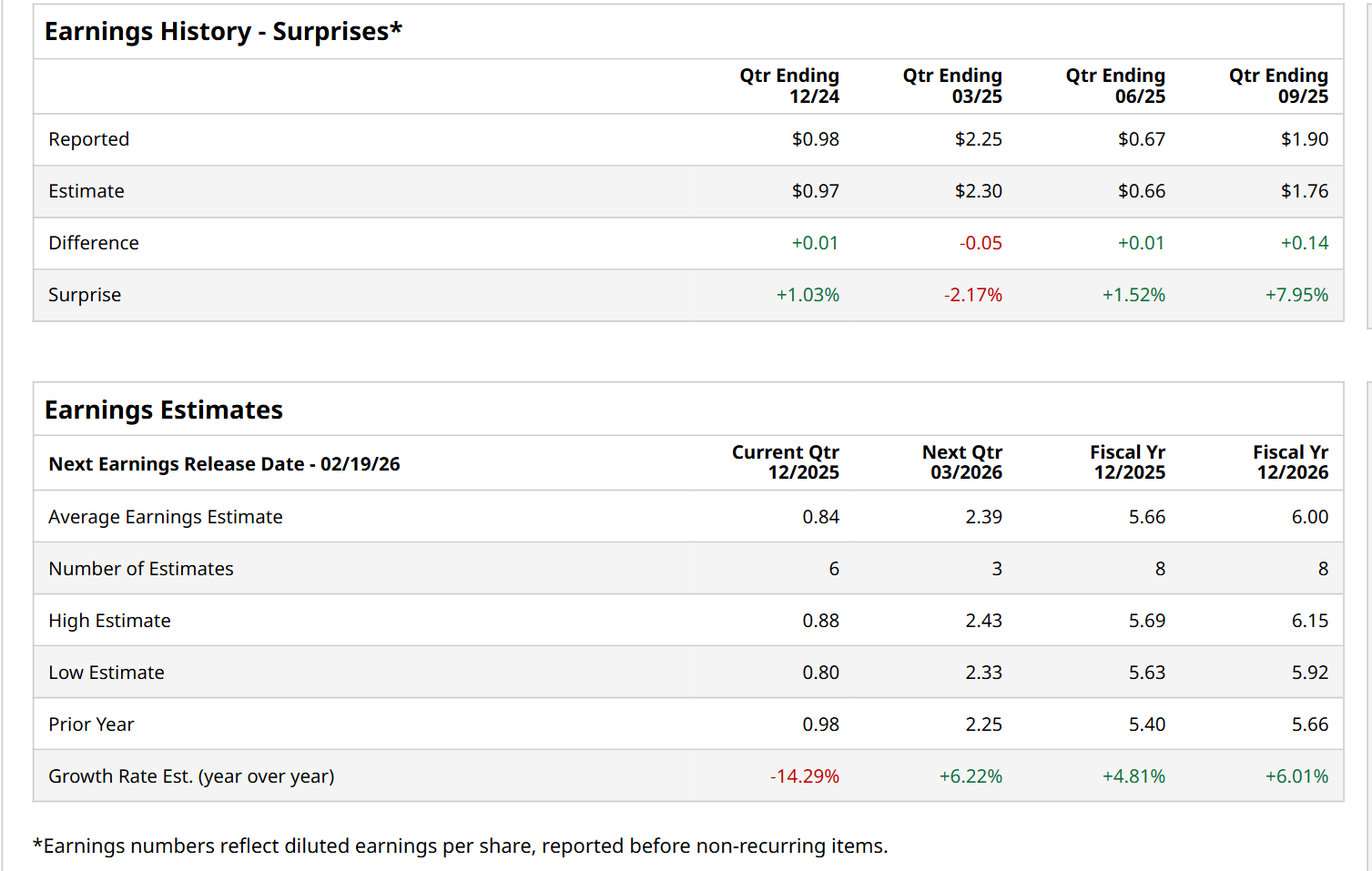

Before this event, analysts expect this utility company to report a profit of $0.84 per share, down 14.3% from $0.98 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.90 per share in the previous quarter exceeded the forecasted figure by nearly 8%.

For the current fiscal year, ending in December, analysts expect ED to report a profit of $5.66 per share, up 4.8% from $5.40 per share in fiscal 2024. Its EPS is expected to further grow 6% year-over-year to $6 in fiscal 2026.

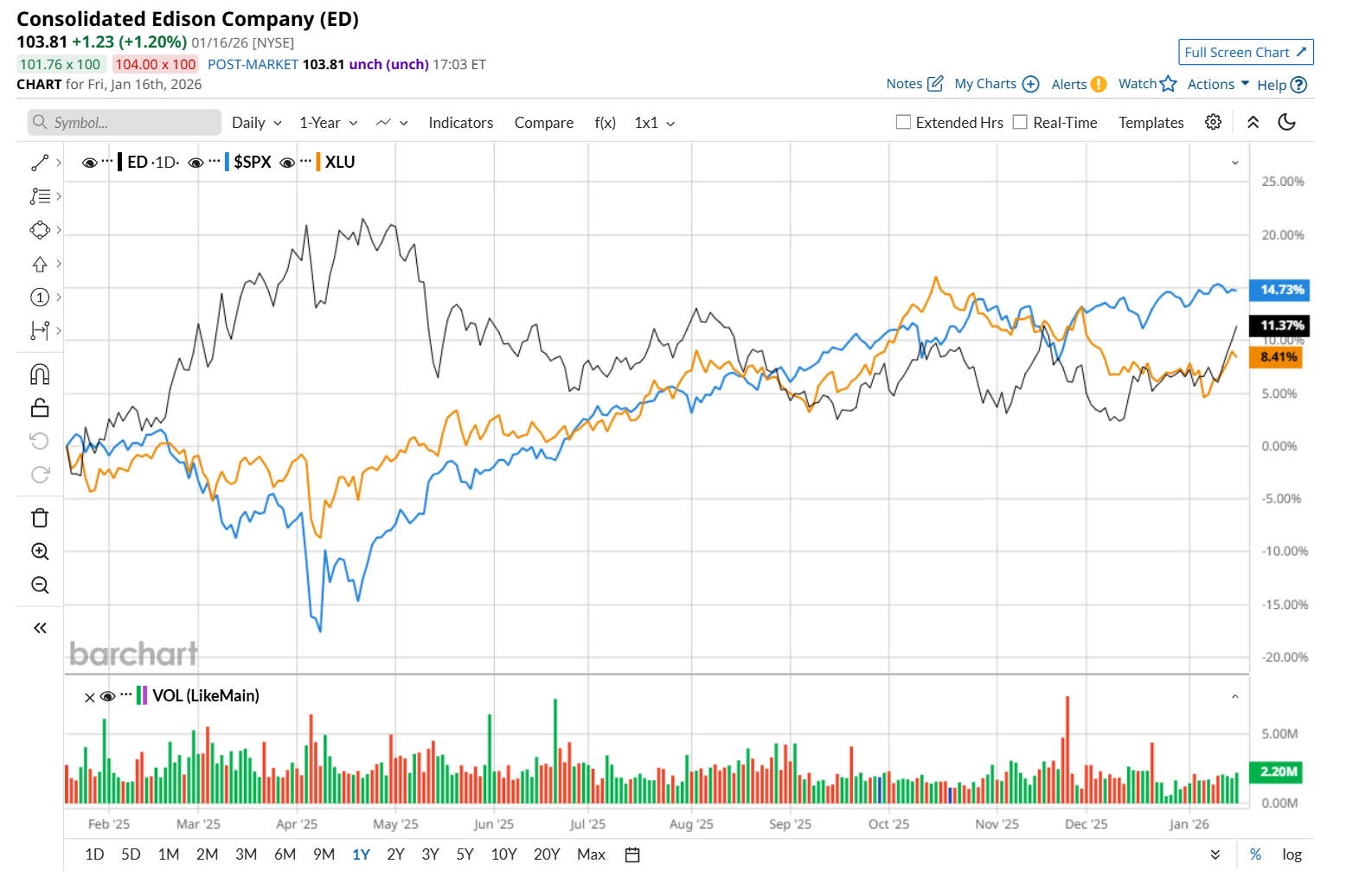

ED has surged 12.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% return over the same time frame. However, zooming in further, it has outpaced the State Street Utilities Select Sector SPDR ETF’s (XLU) 10.2% uptick over the same time period.

On Nov. 6, shares of ED closed up marginally after reporting better-than-expected Q3 earnings results. The company’s adjusted EPS increased 13.1% year-over-year to $1.90, handily beating consensus expectations of $1.76. Moreover, ED raised its fiscal 2025 adjusted EPS guidance in the range of $5.60 to $5.70, reinforcing its strong earnings momentum and further bolstering investor confidence.

Wall Street analysts are cautious about ED’s stock, with a "Hold" rating overall. Among 19 analysts covering the stock, three recommend "Strong Buy," 10 indicate "Hold,” one suggests a "Moderate Sell,” and five advise “Strong Sell” ratings. The mean price target for ED is $104.41, indicating a marginal potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?