Valued at a market cap of $17.3 billion, Alliant Energy Corporation (LNT) is a utility holding company that provides regulated electric and natural gas services. The Madison, Wisconsin-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

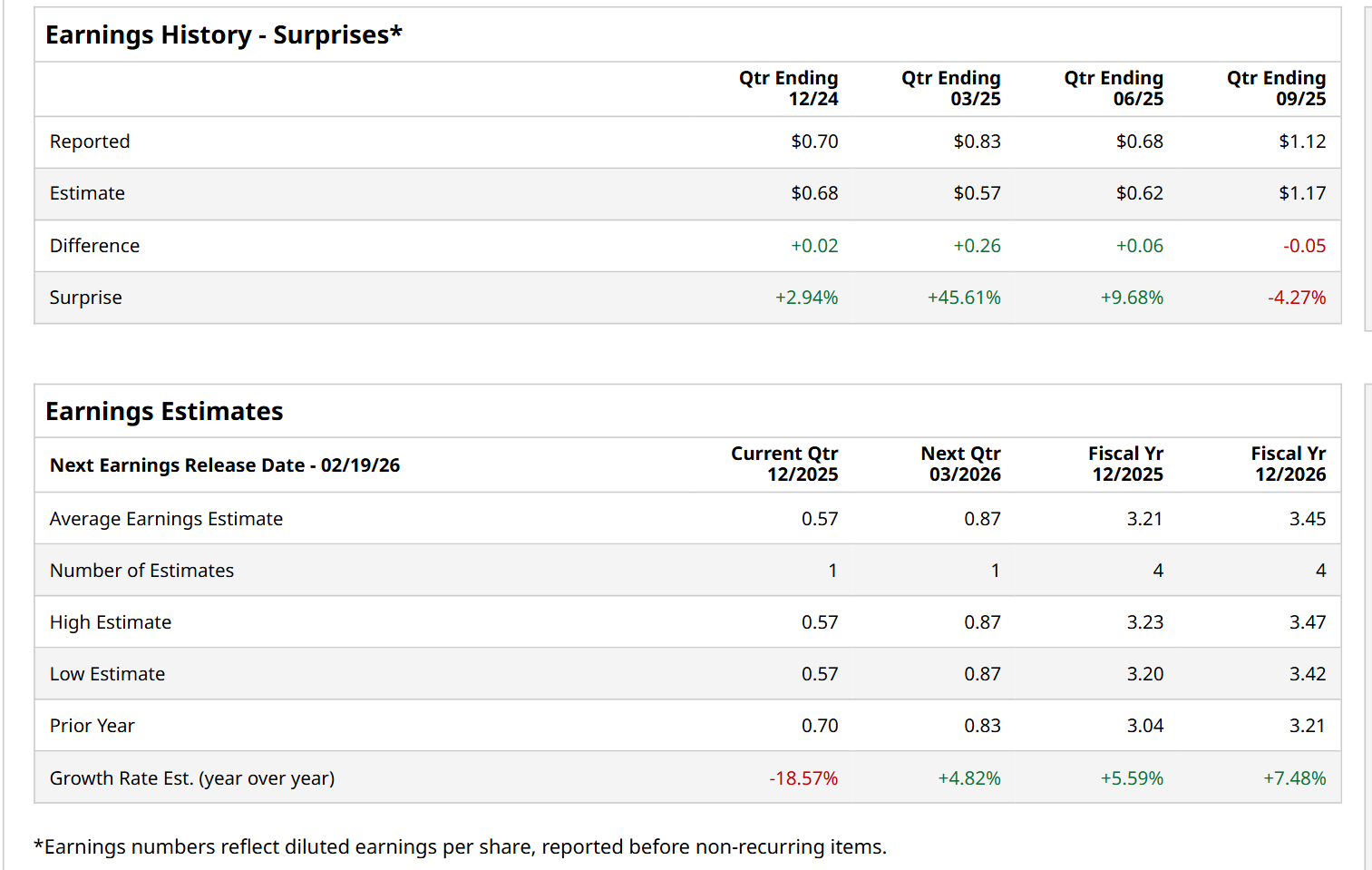

Ahead of this event, analysts expect this utility company to report a profit of $0.57 per share, down 18.6% from $0.70 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.12 per share in the previous quarter fell short of the consensus estimates by 4.3%.

For the current fiscal year, ending in December, analysts expect LNT to report a profit of $3.21 per share, up 5.6% from $3.04 per share in fiscal 2024. Its EPS is expected to further grow 7.5% year-over-year to $3.45 in fiscal 2026.

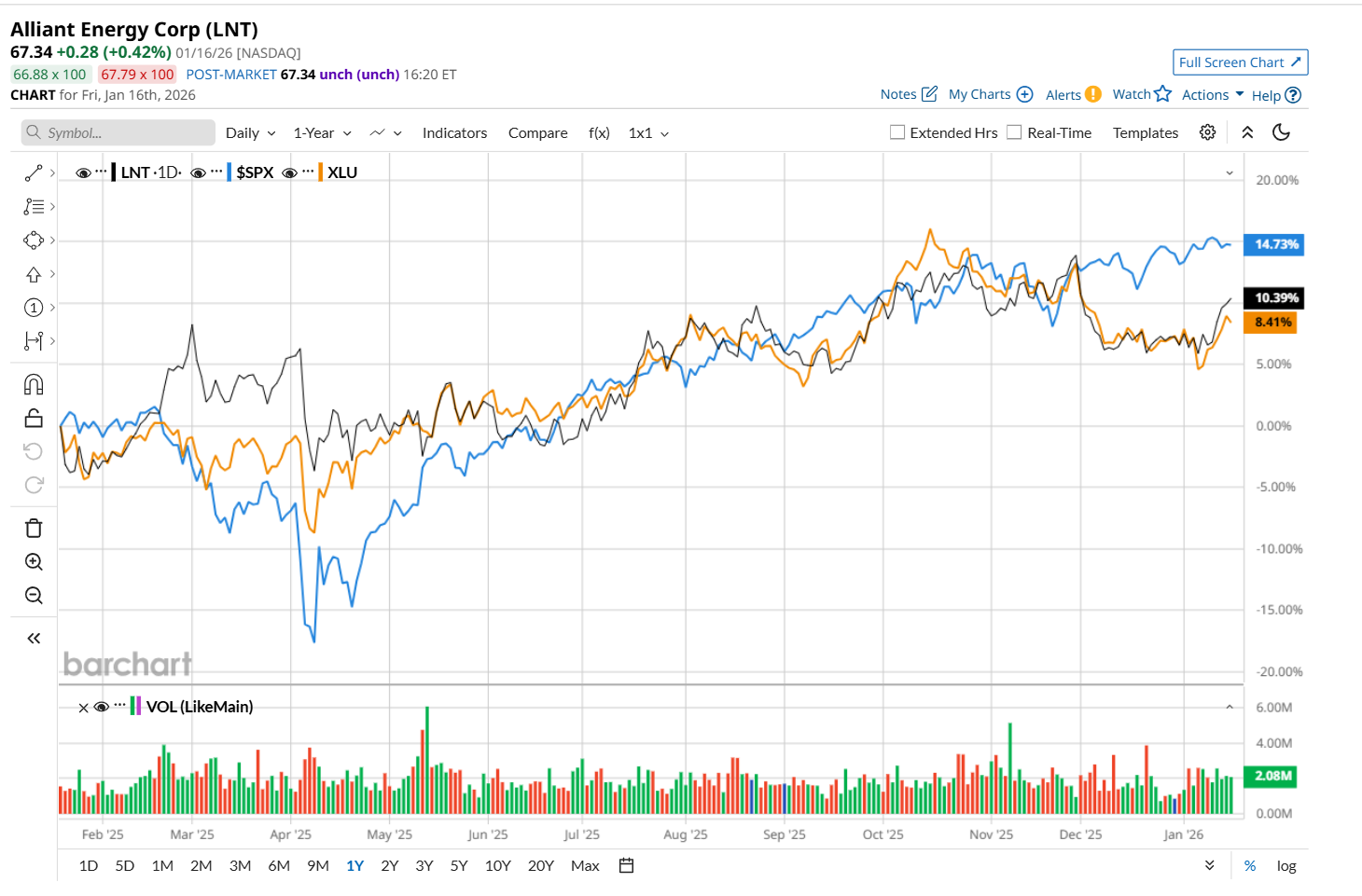

LNT has gained 12.1% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% return over the same time frame. However, zooming in further, it has outpaced the State Street Utilities Select Sector SPDR ETF’s (XLU) 10.2% uptick over the same time period.

LNT posted its Q3 results on Nov. 6, and its shares closed up marginally in the following trading session. Due to a 12.5% increase in electric utility revenues, the company’s total revenue improved 11.9% year-over-year to $1.2 billion. On the other hand, its ongoing EPS declined 2.6% from the year-ago quarter to $1.12, missing analyst estimates by 4.3%. The earnings shortfall was primarily driven by higher other operation and maintenance expenses, depreciation, and financing costs. Nonetheless, despite the bottom-line miss, LNT announced fiscal 2026 earnings guidance of $3.36 to $3.46 per share, continuing its robust 10-year track record of compound annual earnings growth of 6%, bolstering investor confidence.

Wall Street analysts are moderately optimistic about LNT’s stock, with a "Moderate Buy" rating overall. Among 11 analysts covering the stock, six recommend "Strong Buy," four indicate "Hold,” and one suggests a "Strong Sell” rating. The mean price target for LNT is $72.33, indicating a 7.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?