A one-year U.S.-China trade truce and apparent better diplomacy efforts between the world’s two largest economies sparked the grain futures market bulls last week.

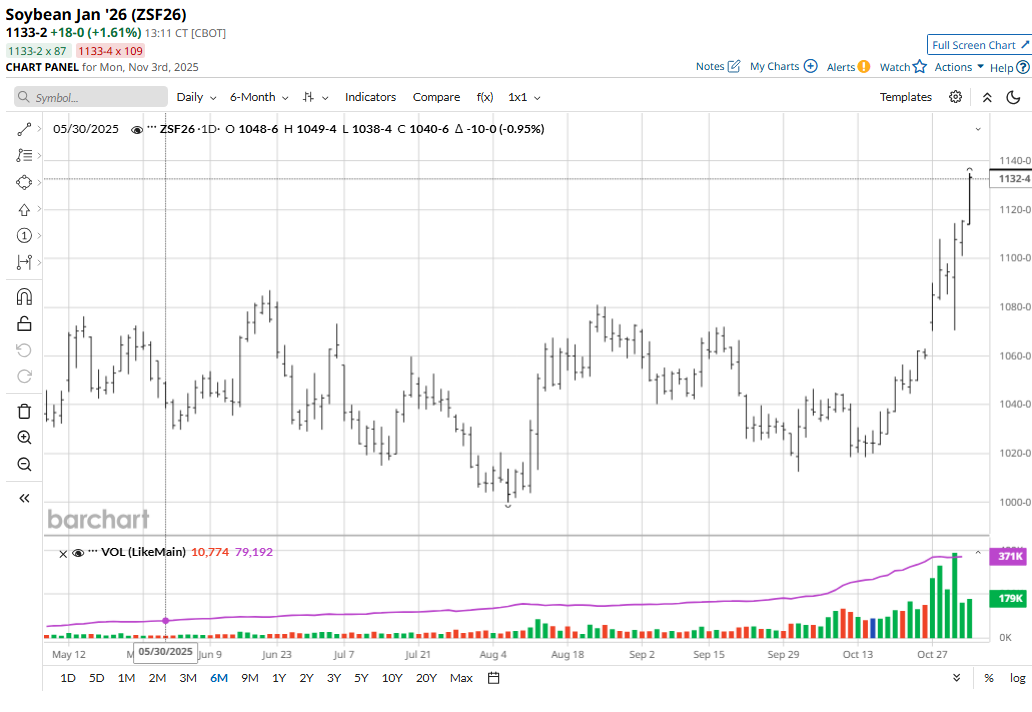

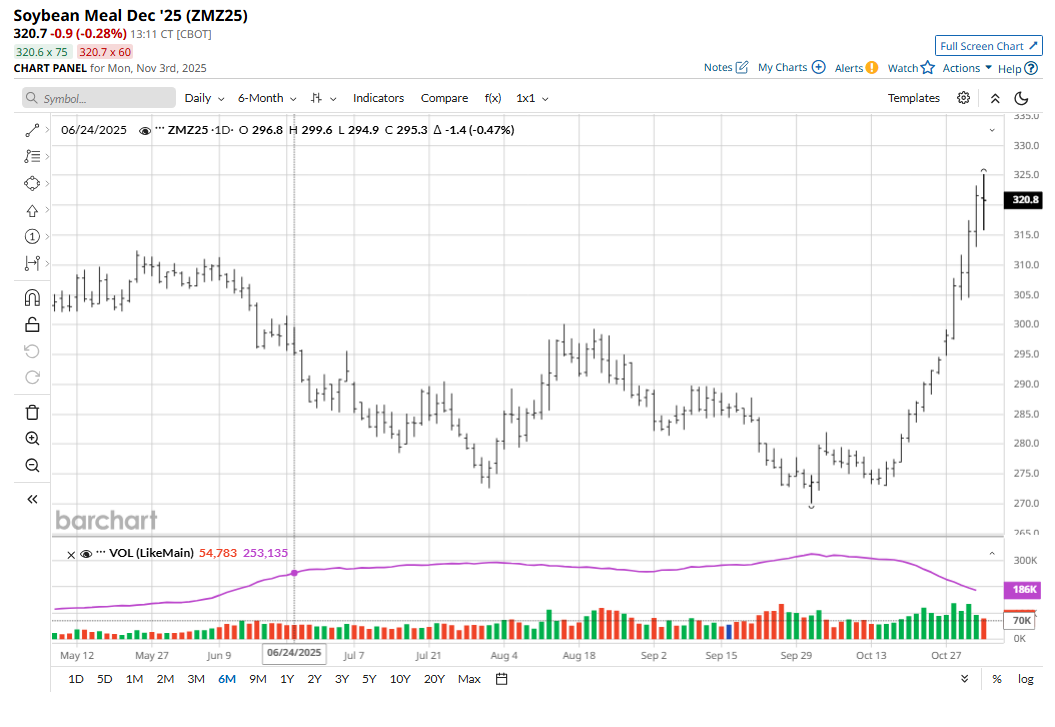

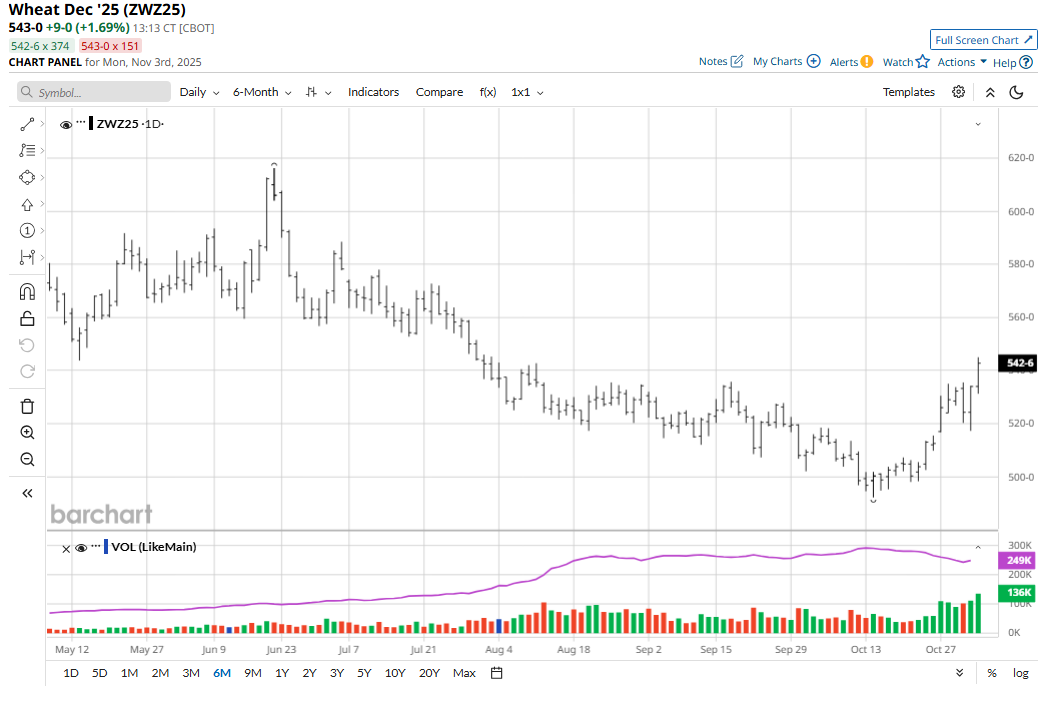

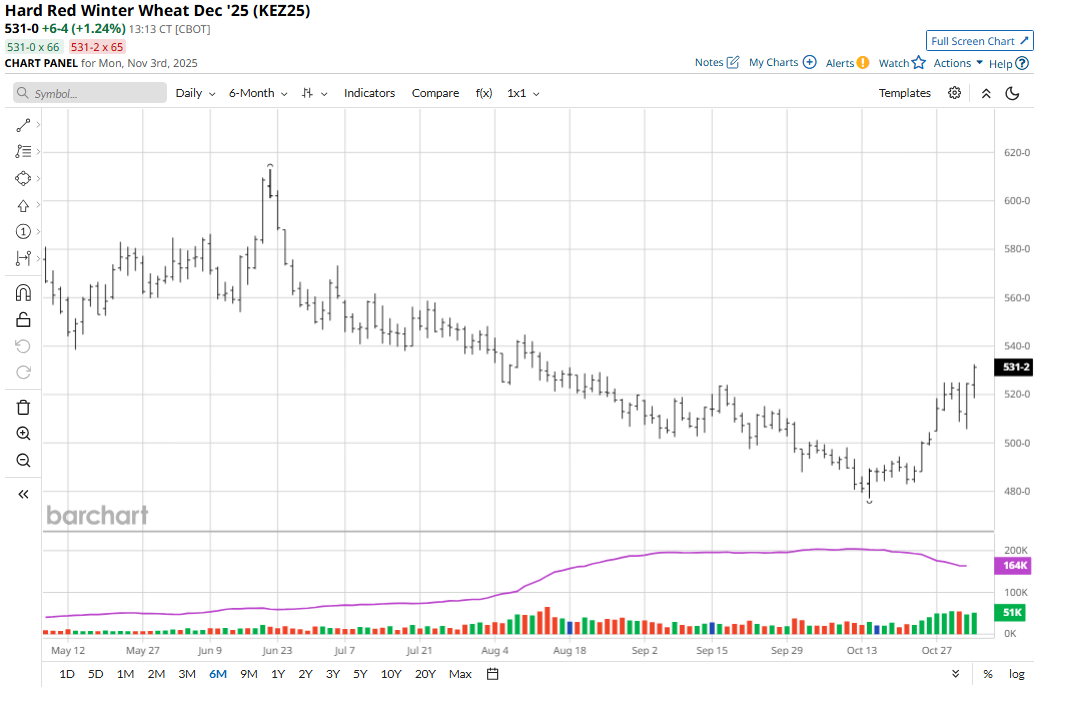

January soybeans (ZSF26) hit a 13-month high on Friday and for the week rose 55 cents. December soybean meal (ZMZ25) hit a nearly nine-month high and on the week gained $23.40. December corn (ZCZ25) futures last week gained 8 1/4 cents and on Friday hit a four-month high. December soft red winter (SRW) (ZWZ25) wheat last week gained 21 1/2 cents. December hard red winter (HRW) (KEZ25) wheat rose 23 cents for the week.

China Reported to Be Buying Big Amounts of U.S. Soybeans

The big news in the grain futures markets last week was that China apparently bought at least four U.S. soybean cargoes after last Thursday’s summit between Presidents Donald Trump and Xi Jinping. The cargoes are for shipment later this year and in early 2026, and the total volume is about 250,000 tons. The soybeans will be shipped from the Pacific Northwest and U.S. Gulf, according to people familiar with the matter and as reported by Bloomberg.

USDA Secretary Brooke Rollins said China agreed to buy at least 12 million tons of U.S. soybeans this year, with sales rising to 25 million tons annually over the next three years. China booked its first U.S. soybean cargoes earlier last week, just days before the summit, lifting a months-long pause. The Bloomberg report said traders and crushers expect China to roll back an additional 10% tariff on U.S. soybeans, which was implemented earlier this year as part of countermeasures against Washington, though Beijing hasn’t been explicit on this yet.

However, even with that cut, U.S. soybean cargoes would still incur 13% duties, making them uncompetitive with Brazil, which is China’s top supplier.

There is doubt among some soybean traders about China fulfilling its commitment of purchasing that many U.S. soybeans this year and next. “Whether China secures 25 million metric tons in future years depends on the price relationships between South America and the U.S. China buys what China needs at the cheapest price offered — its’ that simple,” said one veteran market analyst in a note and as quoted by Dow Jones Newswires.

China Wants U.S. Wheat, Too

Meanwhile, China is seeking to buy U.S. wheat in what would be the first purchase in more than a year, following last week’s trade truce between the two nations, Bloomberg reported. A major grains importer in China made inquiries over the weekend for U.S. wheat cargoes loading from December to February, according to people familiar with matter, who asked not to be named as they aren’t authorized to speak to media. China hasn’t bought any U.S. wheat since early October of last year, according to USDA data, and the inquiries come after the Asian nation resumed purchases of U.S. soybeans last week.

China will suspend all levies announced since March 4 on U.S. agricultural products, according to a White House fact sheet released over the weekend. The fact sheet is the most detailed account yet regarding the U.S.-China trade truce made during the summit meeting last week. The apparent renewed interest in U.S. wheat comes as China’s overall imports of wheat have fallen to less than a third in the first nine months of this year from the same period in 2024 as Beijing moved to bolster domestic prices due to sluggish demand and ample supply.

Technicals in the Grains Are Near-Term Bullish

The technically bullish weekly and monthly high closes in soybean, soybean meal, SRW wheat and HRW wheat futures markets on Friday have the chart-based bulls more fired up to continue to be buyers early this week. Technicals remain fully bullish for beans and meal, but the Relative Strength Index is flashing very overbought conditions in both markets at present. Don’t be surprised to see some corrective selling pressure at some point this week.

Spreaders continue to buy meal and sell soybean oil futures. The technical posture for corn has also turned near-term bullish recently.

(Put December soybean oil futures daily chart here.)

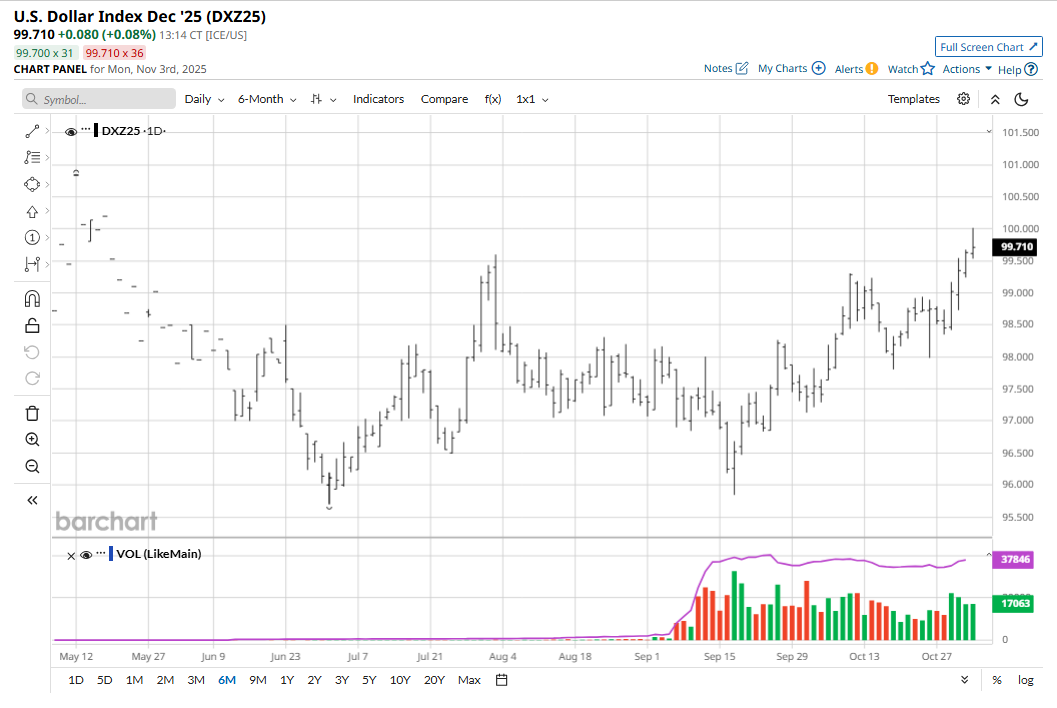

Rallying U.S. Dollar Index Is Price-Negative for Grain Futures

The U.S. dollar index ($DXY) on Friday hit a three-month high and is trending higher. The USDX is an important outside market for the grain futures. Most grain traded on the world markets is priced in U.S. dollars. An appreciating greenback makes U.S. grain more expensive to purchase in non-U.S. currency. Continued strength in the USDX in the coming weeks and months would be a bearish element for grain futures.

Grain Trader Focus Turning to South American Growing Seasons

Weather in Brazil and Argentina, as their growing seasons are under way, will be a main fundamental topic for soybean, corn, and wheat traders in the next few months. Traders are expecting a large Brazilian soybean crop to go into the ground this year.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Grain Bulls Are Back in Business as China Resumes Soybean, Wheat Purchases. What Comes Next?

- China Wants to Buy U.S. Wheat. How to Play Wheat Futures Now.

- Upcoming U.S.-China Talks Create 1 Bullish Soybean Trade Here

- Corn and Soybean Rallies Just Gave Winter Wheat and Soybean Meal a Kick. What Comes Next?